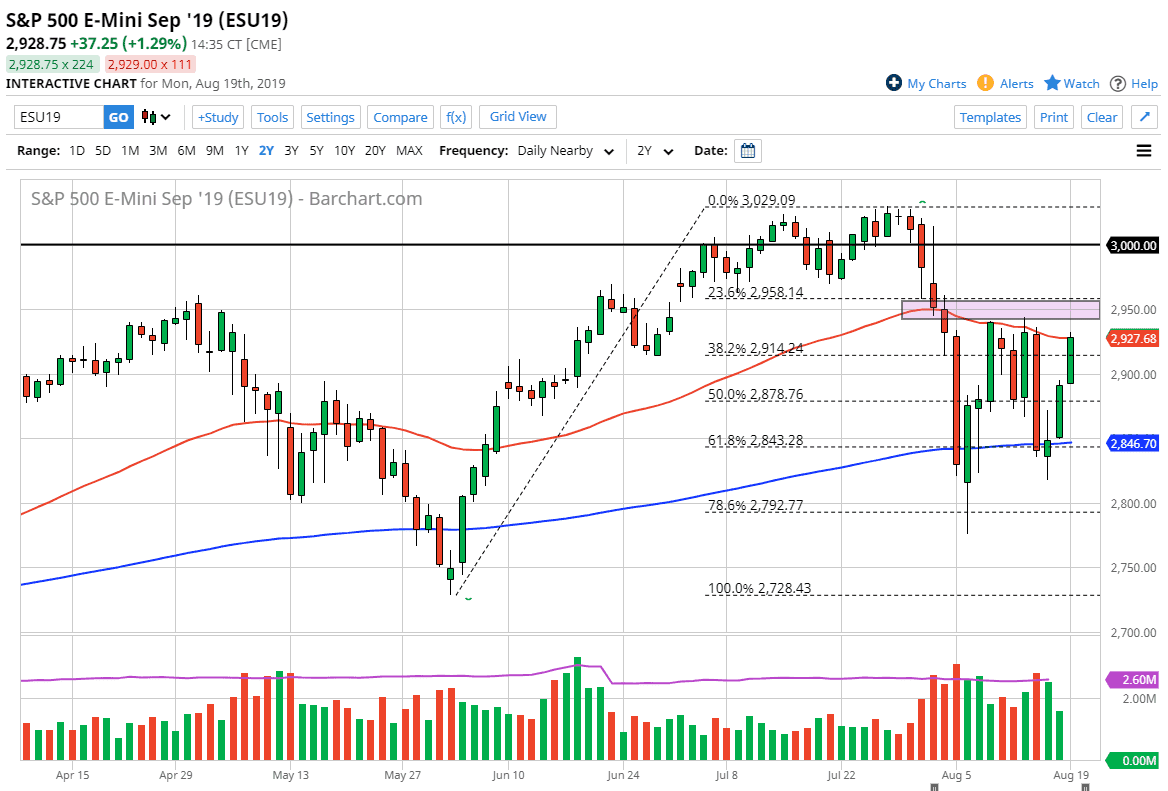

The S&P 500 rallied quite nicely during the trading session on Monday, reaching towards the 50-day EMA when traders finally went home. At this point, it looks as if the 2950 level above is the target and could be the barrier that the market needs to overcome in order to go much higher. If we do break the 2950 level it’s very likely that we could go looking towards the highs again which are basically at the 3030 level.

If we don’t get that break out to the upside, then we probably pull back towards the blue 200-day EMA. This market does look as if it is trying to strengthen though, so it’ll be interesting to see how this plays out. A lot of this is based upon the fact that Donald Trump is more likely to extend an olive branch in the US-China trade war as US companies are starting to feel the pinch (as is Trump’s re-election campaign). Ultimately, Huawei is going to be given another 90 days to buy US parts, which of course helps that situation overall. The question now is whether or not the Chinese will reciprocate. If they do, then we should see stock markets rally around the world.

If they don’t, then things will get interesting. If China does not reciprocate some type of positivity, it’s very likely that the Americans will drop the carrot and pick up the stick again. That would be reason for the market to roll right back over. We are literally moving on headlines around that situation now, and now we also have the added specter of the Jackson Hole Symposium going on this week. Jerome Powell has a speech on Friday that people will be paying attention to, which is aptly about the challenges of monetary policy.

People will be paying attention and looking to see whether or not the Federal Reserve is going to continue to be dovish, which I think most people expect that to be the case. With that being the situation that we are in I suspect that stock markets will continue to find reasons to go higher, but we may have to pull back a little bit to build up a bit of momentum underneath. As far as selling is concerned, we would need to wipe out the Thursday candle in order to get overly bearish suddenly.