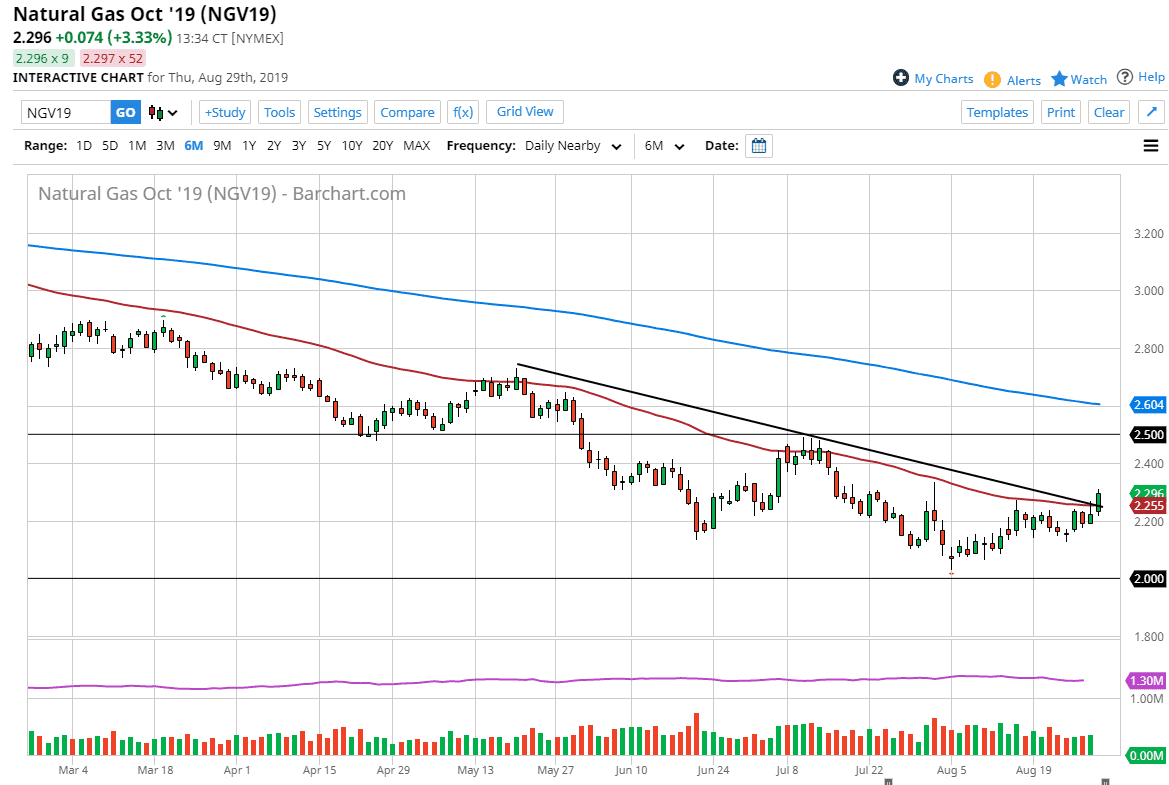

Natural gas markets rallied a bit during the trading session on Thursday, breaking above the 50 day EMA. This of course is a very bullish sign, especially considering that we had not only broken above the 50 day EMA, but we have seen the market break above the downtrend line as well. Now that we have done that, it looks like we may try to continue to go much higher, especially considering that the market has broken above the top of the shooting star from the previous session.

While I am not bullish of natural gas in general, it does look like we may have a little bit of a rally coming, perhaps it is more or less going to be a relief rally. That being said, I think there is plenty of resistance above, especially near the $2.40 level and most certainly the $2.50 level. It is probably far too early to see the “Winter bounce” that you get most years due to the higher demand for natural gas to heat homes in the northern hemisphere. Because of this, it’s very likely that the market will have a short-term rally, but I do think that the sellers will come back rather quickly. We may be in the middle of the bottoming pattern that precedes the rally every year, so this point I think it’s going to be a very difficult market.

I believe that this market will probably favor sellers overall for the next several weeks, but there will come a very impulsive weekly candle stick that will change everything. Again, it’s probably a bit early for that to happen but it does look like we are getting closer to that time of year. We are currently trading the October contract, so at this point it’s likely that we will see a bit of volatility over the next several weeks. I think that we need to pay attention to every $0.10, as the market tends to react all of those levels. I think that it’s only a matter of time before one of those levels turned the market around, but I would also argue that after a pullback it’s one of those levels below that will also cause the market to rally. One thing is for sure, the weekly close is going to be very crucial going forward for the next several candlesticks.