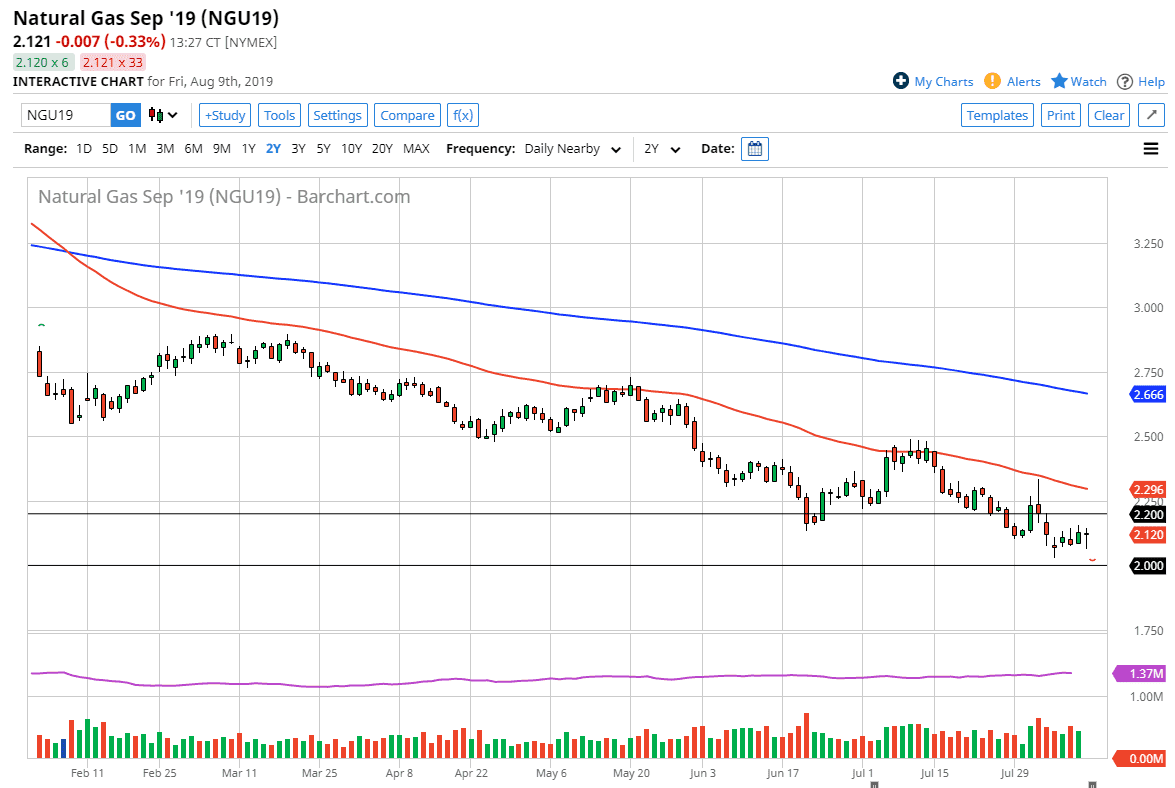

Natural gas markets initially fell during the trading session on Friday but then turned around to bounce a bit during the trading session on Friday to show signs of support. At this point, there is a significant amount of selling pressure above, so having said that it’s likely that any rally at this point should give us an opportunity to continue the longer-term trend. I do believe that it is a bit oversold at this point, but it’s obvious to me that you can’t buy this market.

The oversupply of natural gas continues to be a major concern for this market, although we are at extraordinarily low levels. It is the wrong time of the year to expect significant bullishness and natural gas, as the temperatures are far too warm in the United States and Europe. Having said that, they aren’t necessarily going to be hot during the month of September very often, so it’s not necessarily going to be bullish as far as cooling is concerned either.

Adding even more “fuel to the fire” so to speak, is the fact that the global economy seems to be slowing down, thereby driving down demand for natural gas. I believe at this point natural gas will continue to struggle on rallies, but you can’t just jump in and start shorting. You need to find a reason to get short of this market, perhaps exhaustive candles after a bounce or a touch of the 50 day EMA. I also believe that the $2.20 level will begin significant resistance that sends sellers back into this market.

The $2.00 level underneath is massive support, but it has been broken before. Because of this I don’t rule out that opportunity, but I feel much better about fading rallies and I do trying to sell a market that is so oversold. As we start trading the November and December contract, then we can start to think about buying natural gas, because it will be in huge demand. However, until we get to that point I think we continue to see a lot of weakness in the commodity that is so oversupplied it’s not even funny. Until we get some type of room to move though, I would simply wait for an opportunity to sell. If we did rally above the shooting star from about 10 days ago, then we could see a move towards the $2.50 level, but it’s not until we break above there that I would expect some type of continuation to the upside.