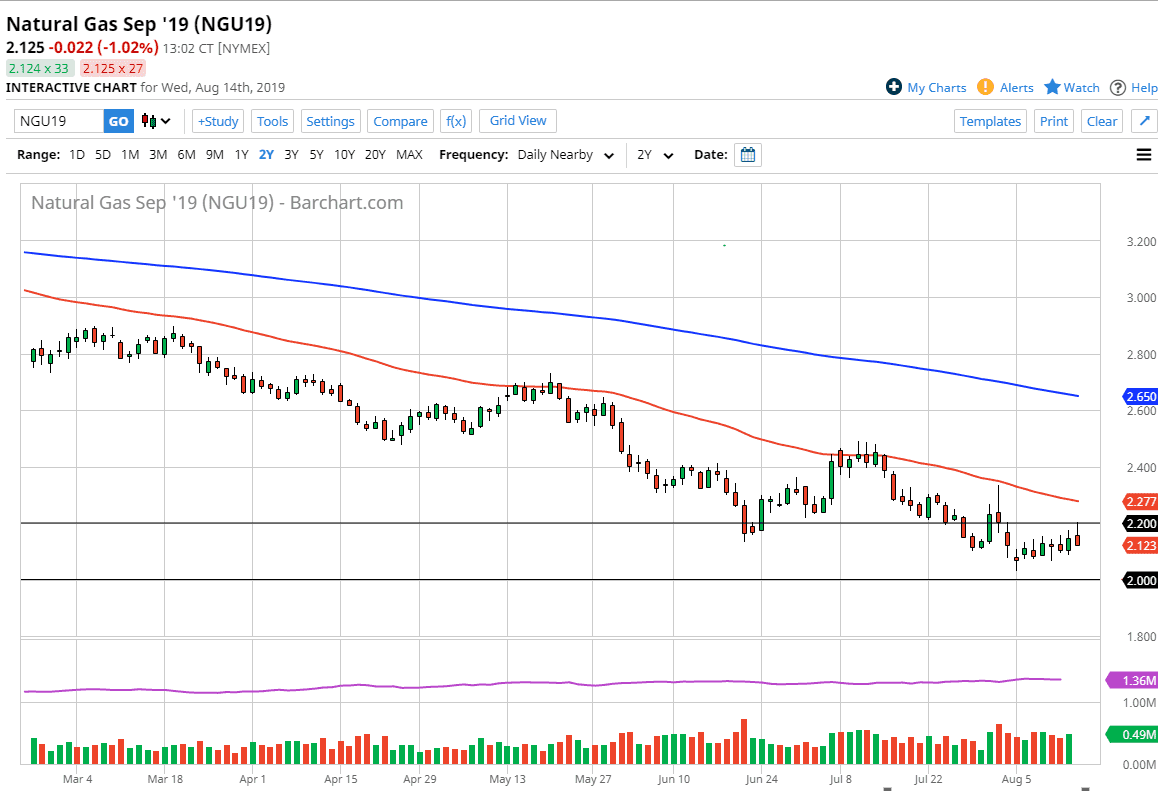

Natural gas markets rallied a bit during the trading session on Monday, but then turned around to fall rather hard from the crucial $2.20 level. This is an area that I have been talking about for some time so it should not be a huge surprise that we had seen a bit of selling in that region. At this point, it’s very likely that the market will continue to find plenty of pressure to the downside as the market is oversupplied.

Looking at the chart, the $2.20 level of course is a major round figure. Above there, we also have the 50 day EMA which is still going to drift lower, offering plenty of resistance. The $2.25 level of course is a round figure as well, and therefore I like the idea of selling every time we try to rally, but this is nothing new. I’ve been telling you this for some time and of course the overly bearish market continues offer plenty of selling opportunities. I think that every time we rally at this point, the very first time you see a bit of exhaustion you can put out a small shorting position. In fact, it’s not until we break above the 50 day EMA that I would be considering buying this market, and I don’t see that happening anytime soon.

To the downside, I believe that the $2.00 level is a major target and could offer a bit of support. Ultimately though, I do think that what we are going to see is the market trying to get down there to break through it. If it does, it’s very likely that the market could go down to the $1.75 level. At this point, I don’t anticipate seeing that but I do recognize the potential. If we can break above the 50 day EMA, then we could go looking towards the $2.50 level which should also be massive resistance.

Looking at the longer-term outlook, I believe that the market will rally eventually, as we start trading colder temperatures. We are doing that yet, so at this point I still expect to see failure every time we rally. Once we get closer to a cold contract, which generally starts trading in November, then we may see a short-term pop which is a cyclical type of scenario. Until then, I don’t see any reason for buying.