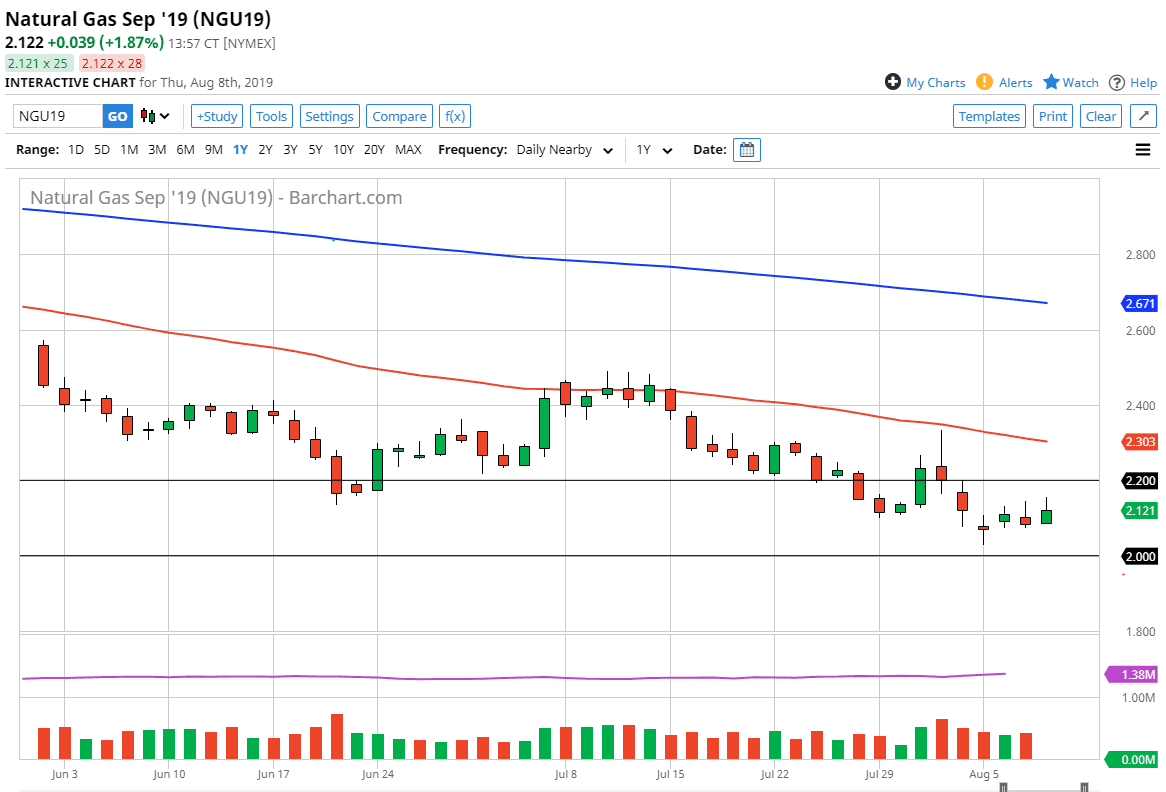

Natural gas markets rally during the trading session on Thursday as we continue to reach towards the $2.15 level but also continue to see quite a bit of trouble. At this point, I believe that every nickel or so you should be looking to sell natural gas, as we have seen so much in the way of negativity for quite some time and therefore it’s likely that every time we try to rebound a bit, people will be looking to short this market.

This isn’t to say that we will get the occasional rally, or that we can’t rally significantly. That being said though, I do recognize that the $2.20 level is going to be a lot of resistance, just as the 50 day EMA will be which is pictured in red on the chart. All that being said, I think you can look for short-term selling opportunities at best. This is because we have so much in the way of importance attached to the level just below which of course I am talking about the $2.00 handle. That is an area that will obviously attract a lot of attention, as it is such a huge figure.

If we were to break down below the $2.00 level, then the market is likely to unwind quite drastically. I don’t how far we can go from there, but I would have to believe that there must be an absolute ton of stops underneath there that could be triggered, adding more selling pressure. I believe that the market is probably best to simply fade it occasionally, as we can take advantage of the occasional pop. We are not in the right time of year to expect some type of significant move, as there will be as much demand for natural gas not only due to the lack of cold weather, but also the fact that we have a bit of global slowdown out there that will course drive down demand. It’s a simple function of supply and demand, we have way too much in the way of supply.

In a couple of months, we will get the typical spike through the cold months, but that’s a short-term buying opportunity. Eventually we get a little bit overextended, and then it’s time to start selling again and hanging on for massive moves to the downside. The fundamentals for natural gas are not changing.