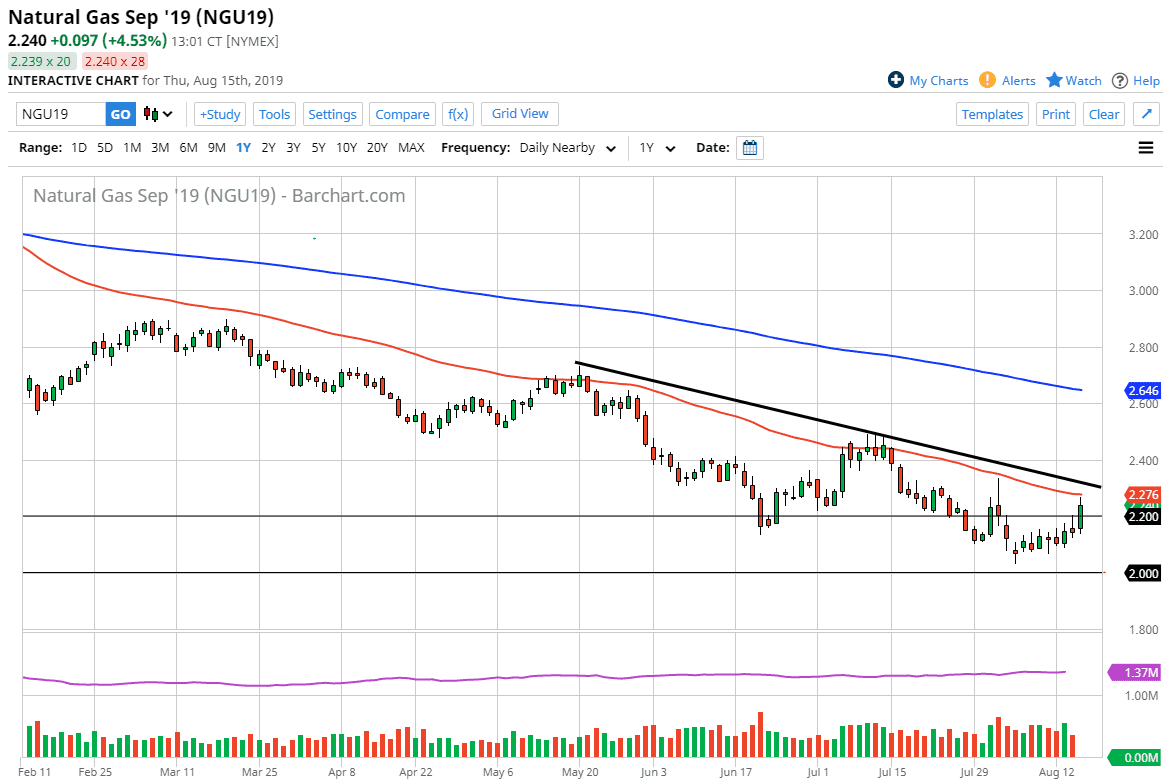

The natural gas markets rallied rather significantly on Thursday, reaching towards the vital 50 day EMA. This is a pretty strong candle stick, and it does show that there is a bit of fight left in this market. Ultimately, I think that the market will find sellers above as the demand for natural gas will continue to shrink. The downtrend line just above the 50 day EMA would be massive resistance, so it’s only a matter time before the sellers come in and punish a market that’s far too oversupplied to be bullish anyway.

Don’t get me wrong, I believe that we will eventually break out to the upside but that has more to do with cold temperatures than anything else. We are a bit away from that, so I do think that the sellers are going to come back in on Friday to send this market lower, or perhaps on Monday. I have no interest in buying this market, and I look at these types of moves as a nice opportunity to short from higher levels. The $2.00 level underneath of course makes a juicy target that I think a lot of people that will be paying attention to. It’s going to be very difficult to imagine a scenario where we break down through there rather quickly. It isn’t that we can’t break down below there, just that the level will attract enough attention that it’s going to take quite a bit of effort to do so.

Looking at this market, if we break down below the $2.00 level, then I think we could go down to the $1.75 handle. All things being equal though, I think what we need to keep in mind that two months from now we will be trading a futures contract that features cold temperatures, and that could be the turnaround. We are in a very negative market, so therefore it’s really difficult to imagine a scenario where we should be buying. Overall, I think that the market will eventually find reasons to fall from rallies, and as a result I think that we simply just follow the trend in the meantime. That being said, if we were to break above the $2.50 level, that could signal that more buying would come in. I doubt it, but it’s always possible that the market turns around and rallies. The demand simply doesn’t dictate it though.