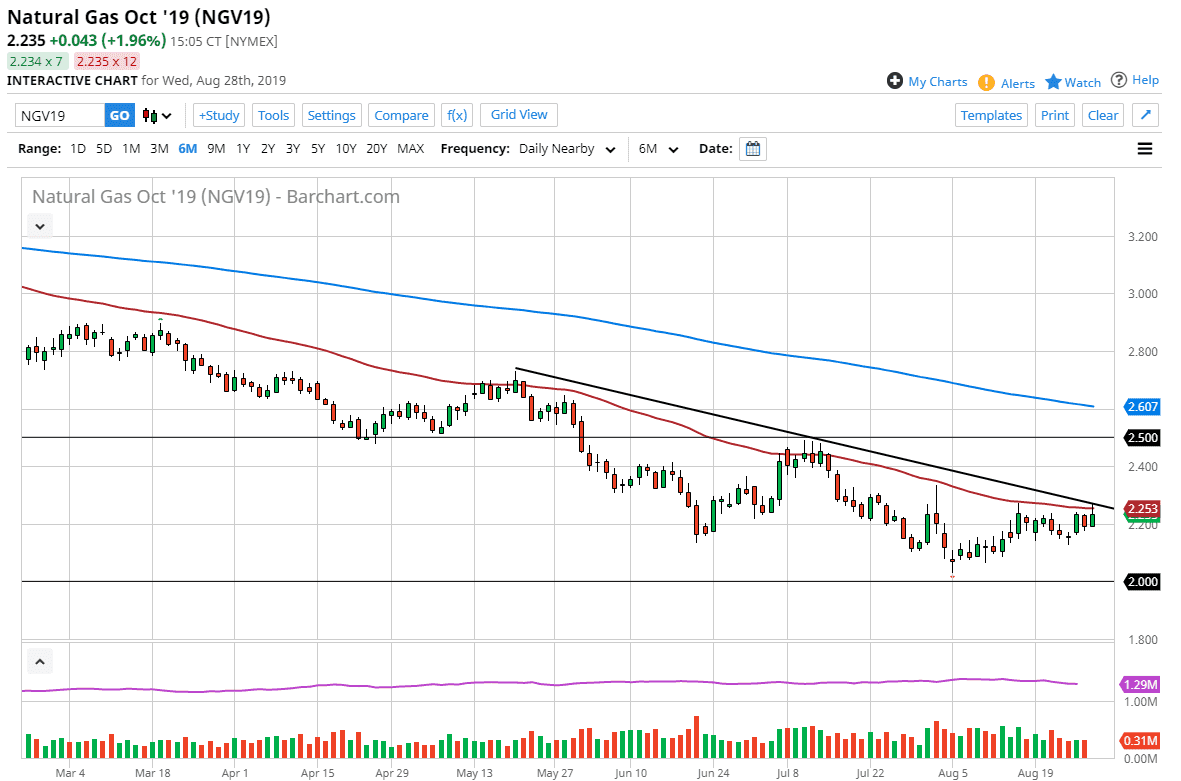

The natural gas markets initially tried to rally during the trading session on Wednesday, but as you can see we have found a significant downtrend line that has held the market down for quite some time. Beyond that, we also have the 50 day EMA in that area offering resistance as well. Ultimately, this is a market that continues to drift lower, and therefore I think that we continue to reach down towards the $2.00 level. That’s an area that is very attractive to a lot of short-sellers, because they know there will be a flood of stop loss orders in that area. Once it does get kicked off, we could see this market drop down to the $1.75 level rather rapidly.

Ultimately though, I don’t think it’s going to be that easy to break through. I believe that we are starting to get somewhat late in the year to think that it’s going to be easy to break this market part, because sooner or later we are going to have to start trading on the idea of colder temperatures for the wintertime. At this point, that is something to pay attention to for the future, but we need to see some type of impulsive candle stick. Once we get an impulsive green candle stick it’s likely that we will be shooting higher.

At this point, the market is likely to be one that you can sell on rallies but this is more or less a short-term trade now. In the meantime we simply look for signs of exhaustion to take advantage of. The downtrend line is holding, so is the 50 day EMA and as you can see previously, every time we have gone a bit flat at the 50 day EMA, it was followed by a push lower. At this point, it’s likely that the market is one that we sell on short-term charts, it’s very likely that the trend should continue. If we were to break above the downtrend line, we could get a bit of a bounce towards the $2.50 level above. We aren’t quite ready for that longer-term move to the upside, so at this point it’s very likely that we continue to see this choppiness with a negative tilt. That being said, I suspect sometime in November will be looking at a move much higher, as we continue to see demand pick up in the market for heating. Until then though, there’s no reason to think that rallies have any legs.