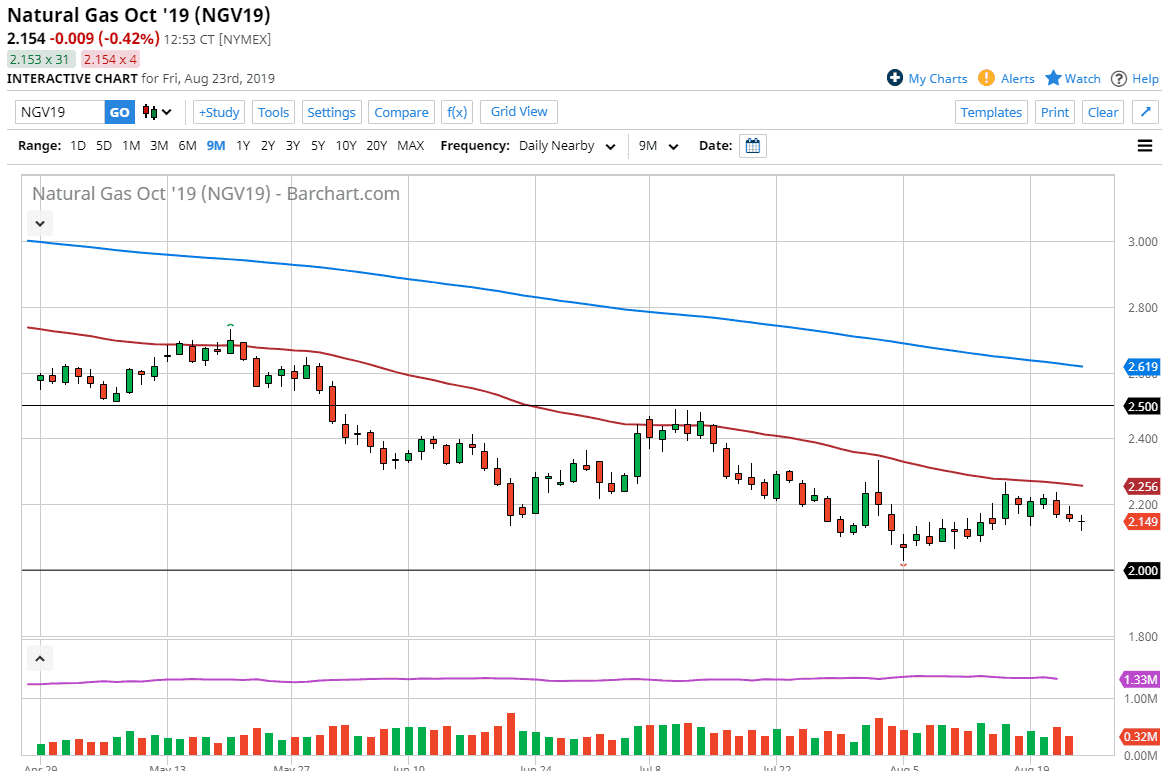

Natural gas markets went back and forth during the trading session on Friday, as we continued to see a lot of trouble with oversupply. The natural gas markets have continued to show a lot of signs of weakness, as the 50 day EMA is starting to drift lower. Beyond that we also have the market that shows that we are getting close to a large, round, psychologically significant figure in the form of the $2.00 level, so it’s obvious that we are going to see a certain reaction to that area. There should be a lot of stop loss orders down there, so it’s hard to imagine that this market is going to ignore that. I think that given enough time we will probably try to trigger those stops. If they get triggered, then the market is very likely to go down to the $1.75 level rather quickly.

Ultimately, if we rally from here, I think the 50 day EMA will cause quite a bit of resistance, especially near the $2.25 level. This is a market that not only has to worry about the oversupply issue, but also the fact that the global situation is starting to deteriorate, as the Chinese have retaliated with tariffs against the Americans. As long as the trade situation continues to be very poor between those countries, it’s hard to imagine that the global demand is going to pick up as it will certainly slow down the global growth situation.

While there is only a matter time before we start trading colder months, the futures markets are currently trading in October. This isn’t exactly the most bullish month, but it is getting a little bit better. There is cold weather coming, and once that happens it’s very likely that we will continue to go higher. All things being equal, the buyers will start to be more aggressive once we start to trade colder contracts, but in the meantime, I think we continue to fade the rallies. Given enough time, the market should start to rally but I think we need to have another crack at the $2.00 level before that happens. I figure we are a couple of weeks away from starting to see buyers come back in, so in the meantime I’m looking for signs of exhaustion. The 50 day EMA will continue to be a nice barrier to bounce back from.