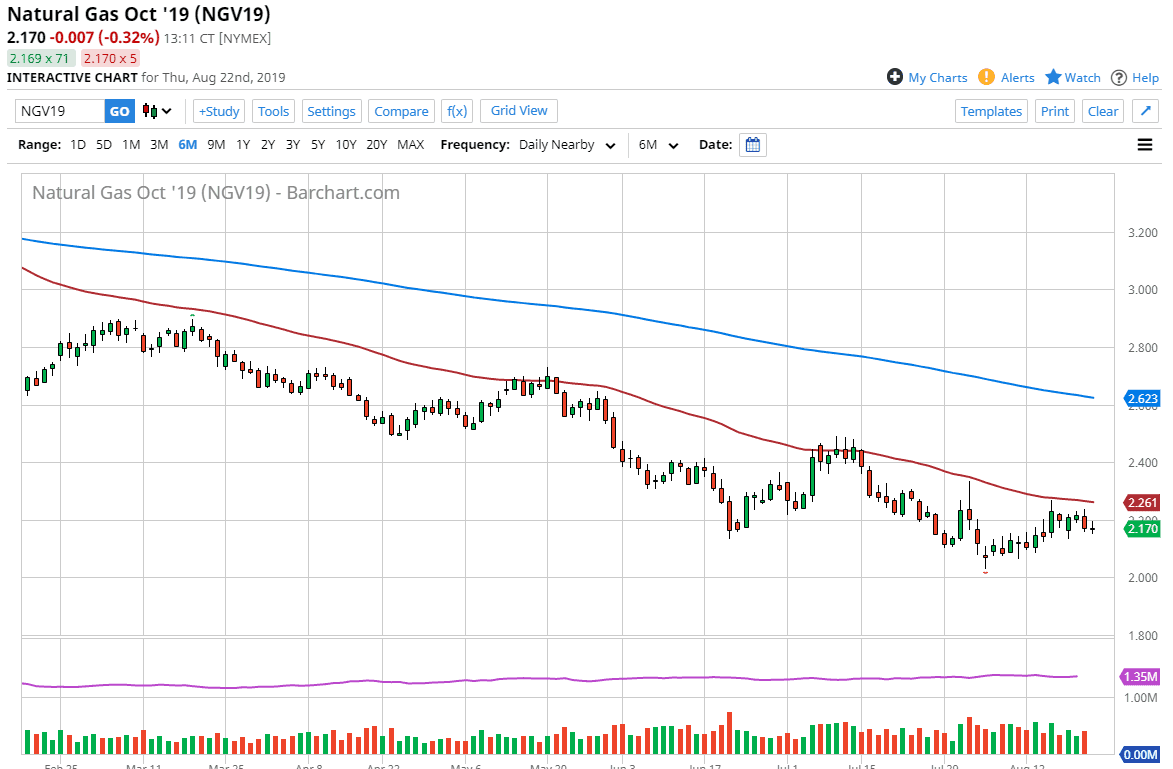

Natural gas markets initially tried to rally during the trading session on Thursday to slam into the $2.20 level. This is a marketplace that is in a negative trend, so at this point it makes quite a bit of sense that we will continue to see quite a bit of selling pressure enter occasionally. With that being the case, I think we are looking at a simple continuation of what has been the situation for quite some time.

Rallies are to be sold, and I do think that the 50 day EMA will be a major barrier for traders to pay attention to. The $2.25 level is just underneath there, so I think there are plenty of reasons to think that technical traders will be interested in in that region. Ultimately, I think we are still going to see selling based upon the fact that we have no serious demand when it comes to natural gas, as temperature simply are warm enough. We have switched over to the October contract, but it’s still rather a bit early for traders to start buying aggressively. We do get the cyclical trade once we get to cold temperatures, causing a massive spike in this market as supply is diminished. That is a very short-term trade though, so it’s simply a cyclical play. Until we get to that point we need to continue to fade any strength.

To the downside I believe that the $2.00 level will continue to be a target, but also massive support based upon the psychology. I think it’s too juicy of a target for short sellers to ignore, so I do think that we will try to get down there. Quite frankly, there just isn’t enough demand for heating when it comes to natural gas, but there’s also the industrial component which should be dropping right along with global growth. In other words, there’s no reason to think that suddenly energy is going to be in high demand, and now that we have rolled over a bit during the trading session on Thursday it makes quite a bit of sense that we short from here and continue to go lower towards the bottom that we recently made. If we did break down below the $2.00 level, the market probably will go down to the $1.75 level after that. That might be a tall order, but it is possible.