Natural gas markets have rallied a bit during the trading session on Tuesday as we continue to see quite a bit of strength over the first couple of days of the week. We have filled the gap from the open this week, so now the question is whether we can continue to go higher. At this point, I think we are starting to run into a significant amount of negativity and resistance, so I think it’s only a matter of time before the sellers come back in and punish the natural gas market.

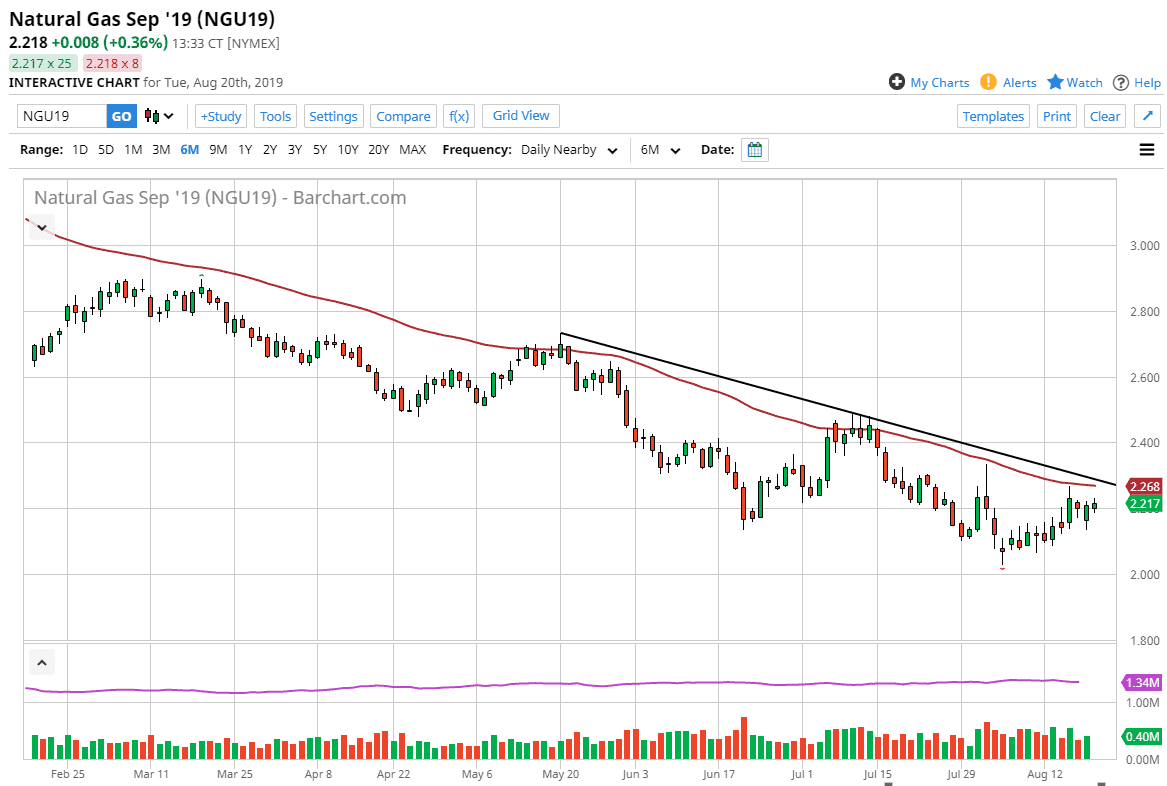

Looking at this chart, I believe that the 50 day EMA which is currently trading at the $2.26 level is going to be the first trouble that buyers may run into, followed very closely by the downtrend trend line that I have marked on the chart which of course is just above that 50 day EMA. I think at the first signs of exhaustion, traders will come back in and short this market yet again.

At this point, the market isn’t quite ready to start trading for the colder months of the year yet, so the demand will probably be somewhat limited. Beyond that, the supply is extraordinarily high, and that of course is going to continue to put downward pressure on this market. Further causing issues will be the fact that global growth is starting to slow down, so at this point it’s very likely that the demand for energy by industry will continue to be a bit of a drag on this market as well.

Ultimately, it’s not until we break above the $2.50 level that I would consider the trend changed, so at this point I’m looking for an opportunity to start shorting. I will probably have to look at short-term charts, but at this point obviously the winning direction over the last several months has been to the downside. It’s possible that the bear market will continue rather quickly, so at this point I am selling the first signs of trouble. I have no interest in buying right now, as we are still trading the September contract which of course isn’t quite the time for the winter heating season to kick prices to the upside. With that, I’m looking for a shooting star or something of that variety to start selling again and aim for at least $2.10, or even the $2.00 level.