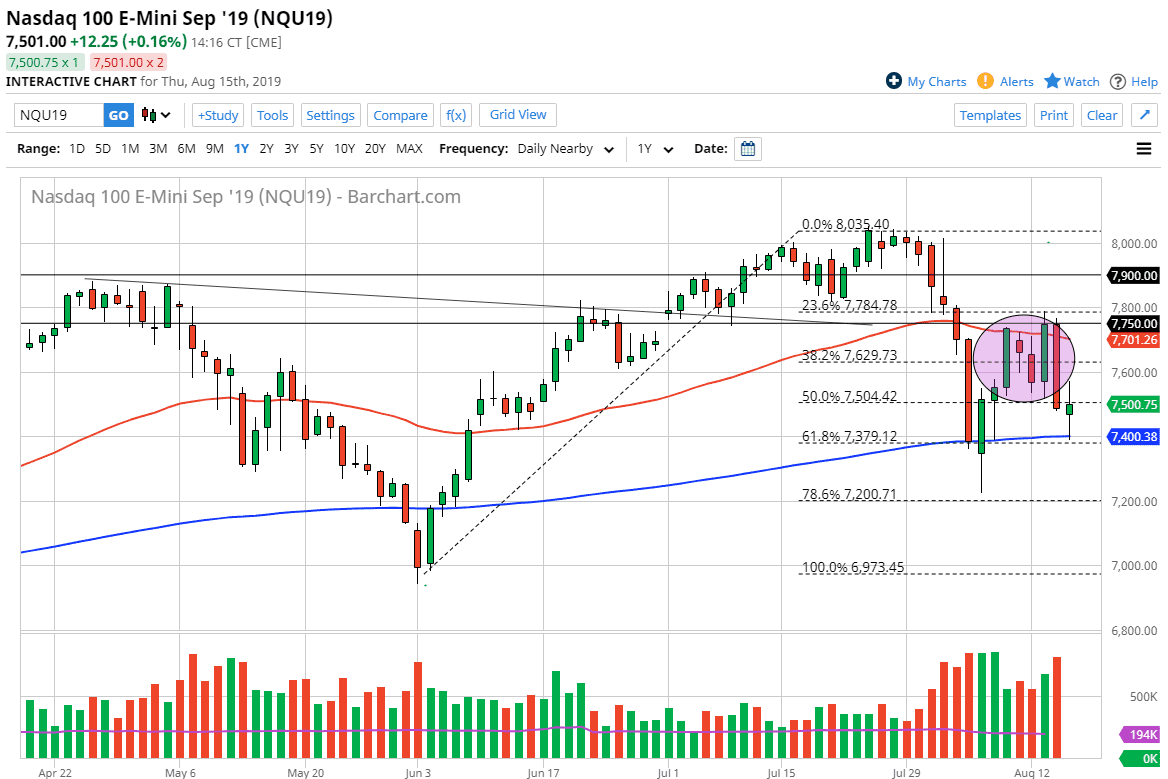

The NASDAQ 100 had an interesting trading session during the day on Thursday, as we have bounced off of the psychologically and structurally important 200 day EMA. The fact that the Americans have helped the markets by stabilizing them probably sends this market back into the previous consolidation area. The catch is that we will probably find sellers above. After all, it was a bit of a bloodbath on Wednesday.

In the short term, I believe that the market will probably continue to try to rally, but I anticipate somewhere near the 7700 level we are going to run into a lot of trouble. This is where the 50 day EMA is, which has been the top of the recent consolidation area between that moving average and the 200 day EMA. Ultimately, this is a market that I think is running into a bit of trouble but I would also point out that the 7400 level underneath not only features the 200 day EMA but it also features the 61.8% Fibonacci retracement level, an area that would attract a lot of attention anyway.

The NASDAQ 100 is a bit of a sensitive market when it comes to the US/China trade relations, which of course are souring. There are a lot of supply chain concerns in that index, as the situation with China seems to be much worse than it was just a few months ago. With that being the case there is a certain amount of shifting from China to Vietnam, but this is a longer-term solution and much less of an immediate one. I think we probably have a bit of a bounce from here but I would not be surprised at all to see the market turned right back around at the 50 day EMA so therefore if I did have a long position on in this market I would probably be a bit cautious about being over levered.

To the downside, if we do break down below the 7400 level, then we could probably go to down towards the 7200 level underneath which was the well recently, and then a breakdown of that opens up the door to the 100% Fibonacci retracement level which is essentially the 7000 handle. All things being equal, I think we have a short-term rally that then gets squashed above. If we did break above the 7750 handle, then we may go looking towards the 7900 level.