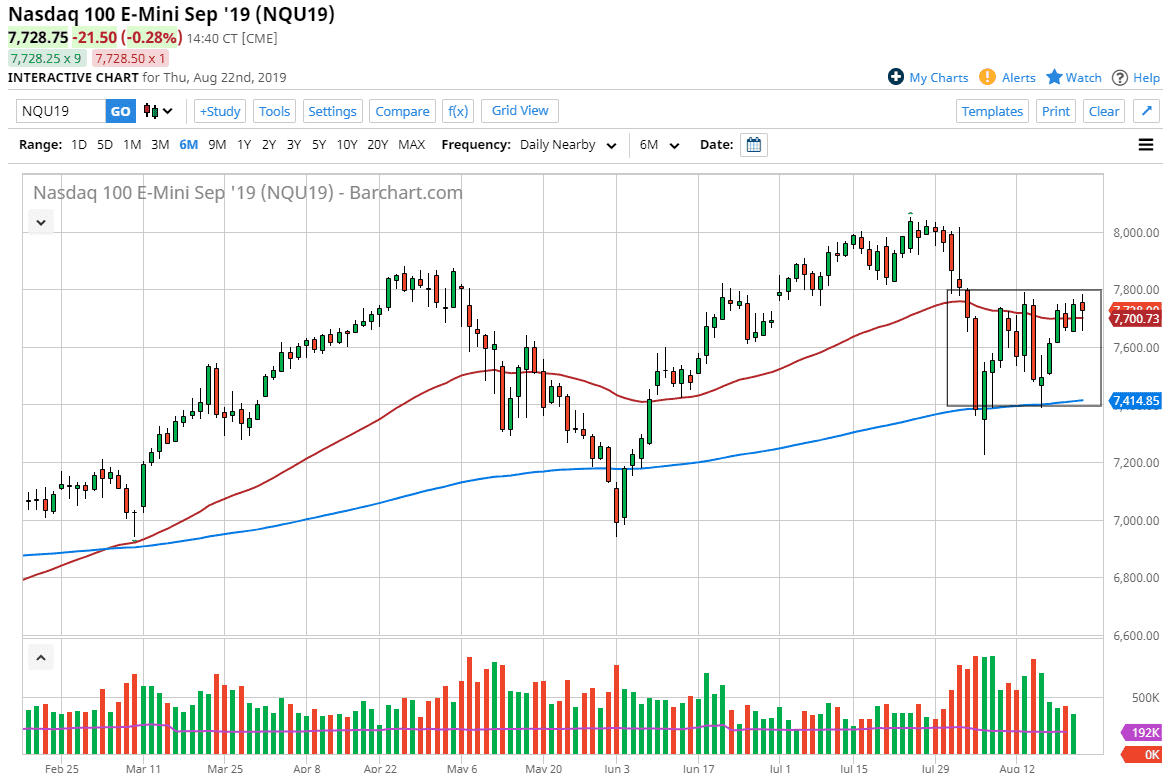

The NASDAQ 100 fell initially during trading on Thursday but has turned around to show resiliency again at the 50 day EMA. That being the case, it looks as if we are trying to break out above the resistance at the 7800 level. With this in mind, it should be noted that we will get a speech at Jackson Hole from Jerome Powell during the trading session on Friday, and that will almost certainly cause some volatility in the stock market, no matter where the technical levels are now. It’ll be interesting to see if we can break above the 7800 level, because if we do it opens up the door to a move towards the 8000 handle. Ultimately, this is a market that looks like it wants to go higher.

The 50 day EMA is slicing through the tail of this candlestick, so at this point it’s likely that we will continue to see a lot of interest in going long. However, if we were to break down below the bottom of that candlestick it’s likely that we could go down towards the bottom of the box that I have drawn, meaning that we could threaten the 7500 level, possibly even the 7400 level which features the 200 day EMA. In general, this is a market that looks like it’s trying to wind itself up to make a move higher, which unfortunately is setting the market up or potential trouble. At this point, we could see Jerome Powell disappoint the market, and if he does that could cause of the sudden sharp move lower that will trick a lot of traders.

At this point, I suspect that by the end of the trading session on Friday we should have an answer as to whether or not that resistance has held. I also suspect that if we close significantly above the 7800 level, the market will continue to go higher, perhaps attacking the 8000 handle. I also believe that if we can break out to the upside it’s likely that we will not only reach that 8000 handle, but eventually break out and go much higher for a longer-term move. This would be essentially what is known as a “sugar high”, meaning that it won’t take much to knock confidence right back down, and one would think that it’s only a matter of time before that happens coming out of either the United States or perhaps China.