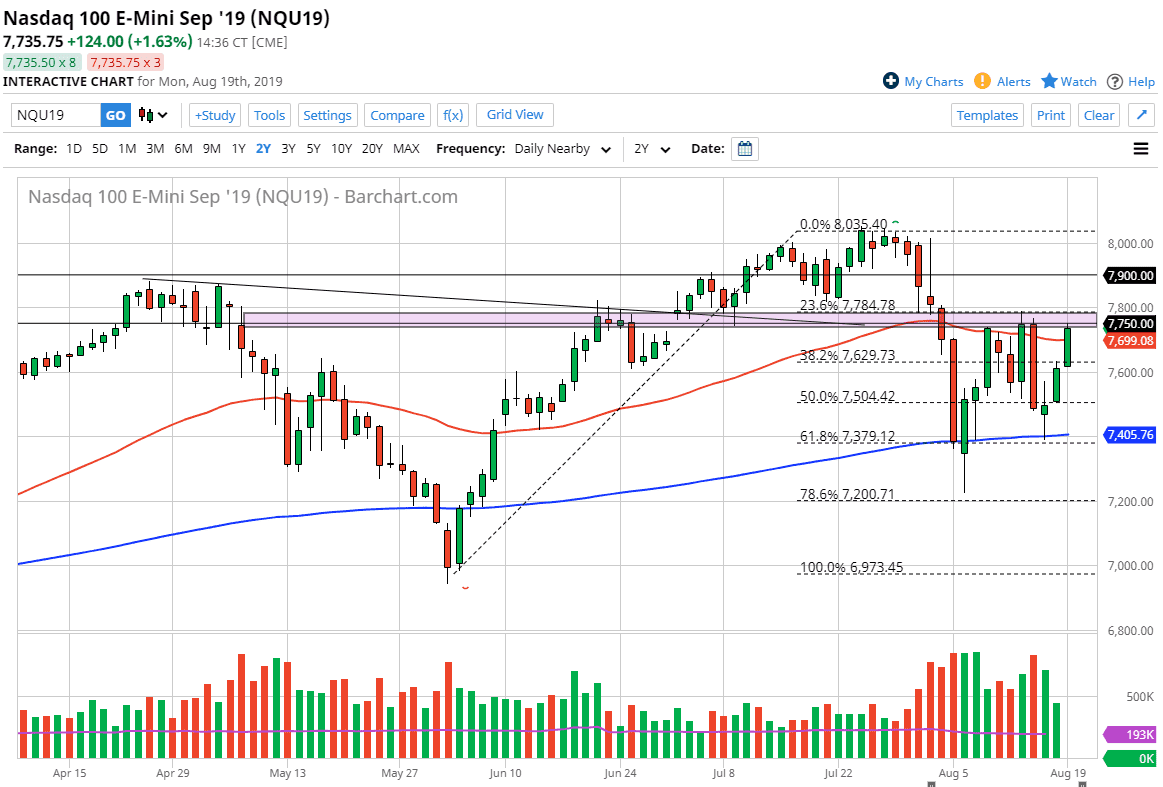

The NASDAQ 100 rallied significantly during the trading session on Monday, slicing through the 50-day EMA after it was announced that Washington was going to give Huawei a bit of a reprieve to buy American parts for the next 90 days. Because of this, there was a little bit of a run towards stocks during the trading session on Monday, but at this point it looks likely that we are going to run into a significant amount of resistance just above.

The 7800 level above is massive resistance as you can see where I have marked on the chart. It has offered resistance of the last several sessions every time we tried to rally towards it, and it is also the scene of a gap from previous trading. That being said, it’s also a large, round, psychologically significant figure so it could attract a lot of attention. Overall, I think that the market face is a lot of trouble here, and it’ll be interesting to see whether or not we can break out. If we do, that would be a very bullish sign and could send this market looking as high as 8000 in the short term. However, if people realize that nothing has truly changed between the Americans and the Chinese, we could see this market pull back. All things being equal, the idea that Huawei may get a bit of an extension from the Americans could send this market straight to the upside as hinted on Monday.

To the downside, it’s very likely that the 7400 level underneath should offer plenty of support due to the fact that the 200-day EMA is right there, and of course the 61.8% Fibonacci retracement level also should attract a lot of attention. At this point, I think the market is going to do one of two things: it will either break out to the upside and continue to go higher, or we are going to pullback in order to form a bit of consolidation between basically 7400 and 7800 at this point. If we were to break down below the 200-day EMA, then things could get rather ugly but right now that seems to be very unlikely. With this, you should be looking at either neutral or bullish conditions in the short term. The 8000 level will of course attract a lot of attention as it is such a big major number.