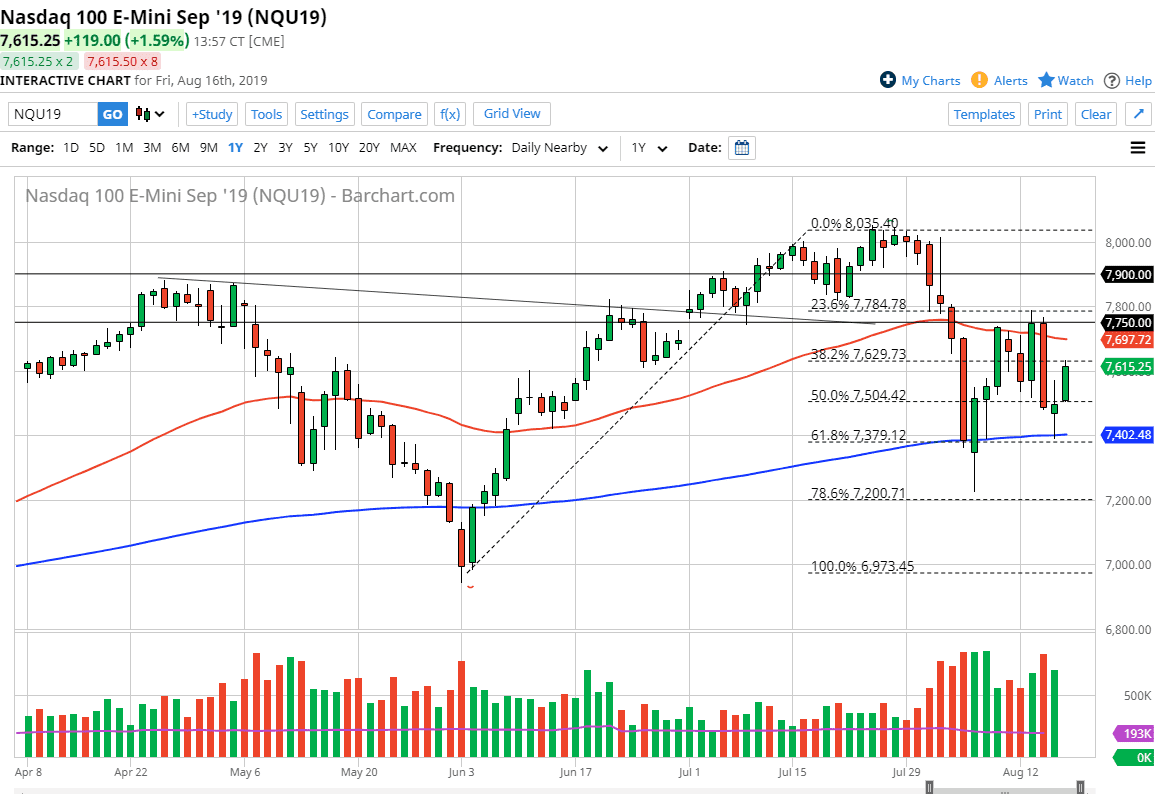

The NASDAQ 100 rallied a bit during the trading session on Friday after breaking above the top of the choppy range on Thursday. This is a good sign, as we had tested the 200 EMA on the daily chart and found it to be supportive. Now that we have broken above that neutral candle for the trading session on Thursday, we have broken through a certain amount of resistance. At this point though, there is the 50 day EMA which is just above, so I think at this point it’s very unlikely that we just sliced straight to the upside.

I believe that the 7750 level will continue to cause a bit of resistance, so if we were to break above that level, I think that the NASDAQ 100 will probably go looking towards the 7900 level, then go looking towards the 8000 level after that. However, I think it’s much more likely that we continue to chop around between these couple of EMAs, as they are two of the most important ones from the longer-term trading perspective. At this point, the 7400 level underneath is support, so I think that also could keep the market somewhat supported beyond the 200 day EMA, not to mention the fact that the 61.8% Fibonacci retracement level is right there as well.

All things being equal I think that we get a lot of choppiness ahead of us, but I do think that the Monday session probably will probably be more bullish than bearish, but I also would not be surprised at all to see this market turned right back around and pull back. I think there is still a lot of confusion out there and you should keep in mind that the NASDAQ 100 is highly sensitive to the US-China trade situation, and at this point it’s very likely that headlines will eventually come out that throw this market around. Then again, you never know exactly what President Trump will tweet next. That being said, I think it’s only a matter of time before something happens. All things being equal, it looks like we are in an area that we need to make some type of major move. Overall, I think we are at a crossroads.