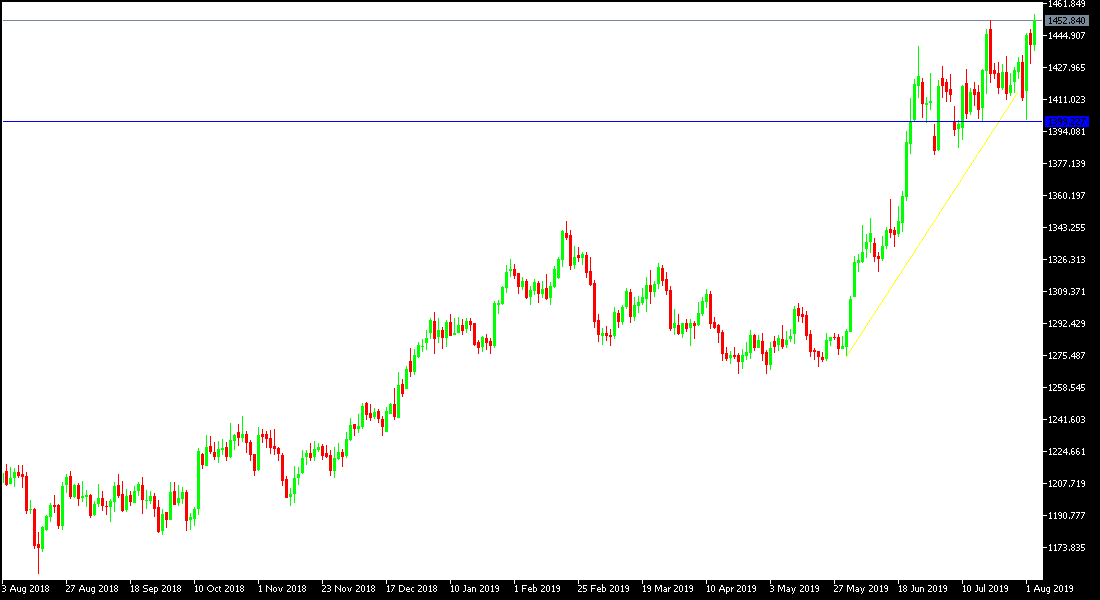

Gold prices started the week with a stronger bullish momentum, reaching resistance at $ 1456, the highest price for six years, as global geopolitical and trade concerns intensify, often supporting investors buying safe heaven assets, notably gold. As we have recently expected in technical analysis, we prefer buying gold from every bearish level, as the fundamentals of support for the bullish move are still firmly in place, most notably is the increase in trade tensions between the world's two largest economies, with Trump last week approving to increase tariffs on China's imports as soon as the two-way trade talks between the two sides failed in Shanghai. Focus is now on China's retaliatory response to that.

By the end of last week, we saw mixed results in the US jobs report. Overall, the US labor market remains strong and the US Federal Reserve relies heavily on tightening monetary policy. Last week, we saw a shift in Federal Reserve monetary policy as the bank cut US interest rates for the first time in 10 years but the bank's decision was not unanimous among its policy members. They stressed that they still believed in the performance of the US economy and that the cut was not the new policy of the bank, but rather an update to the bank's policy cycle.

Factors supporting strong gold gains: No-Deal Brexit - global trade tensions - slowing world economic growth - tensions in the Middle East - all this will support investors buying gold for hedging.

Technically: Gold prices today will continue to gain momentum as long as global trade wars remain and completely ignore the strength of the dollar. Although technical indicators are reaching oversold areas, gold still has opportunities for stronger gains. Resistance levels at 1462, 1475 and 1490 may be the nearest targets to this performance which will support the move towards the following psychological resistance at $1,500 an ounce. On the downside, the nearest support levels for gold are currently 1448, 1439 and 1428, respectively. Overall, we still recommend buying gold from every bearish level.

In terms of economic data: the pair will interact with the announcement of Service Sector PMI from the UK, and ISM Service Sector PMI for the U.S.