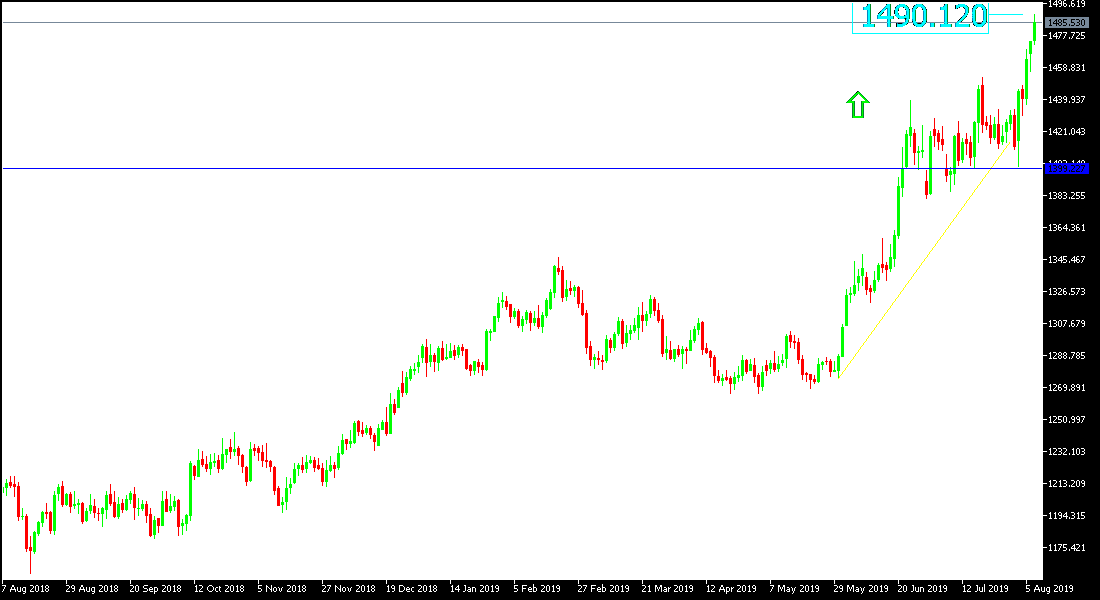

I mentioned in my latest technical analysis that the price of gold may head towards the 1500 psychological peak if it succeeds in testing the resistance 1462 and 1475 levels, and the 1490 resistance has already been reached. Gold has gained stronger momentum recently, reaching its highest level in more than six years, as China began a currency war in retaliation against the United States, which imposes more tariffs on Chinese imports, and is now closer to imposing tariffs on the country's entire imports from there. China's devaluation of the Yuan below 7 dollars will hit US export competitiveness in world markets, and Chinese exports will lead the way in setting record exports and causing the abandoning of US exports. The US dollar is sticking to its strong gains in exchange markets. China's move will increase Trump's criticism of the Fed's policy, which does not work to weaken the US dollar at all.

Underlining that the currency war would be in China's interest is when the Fed cut US interest rates for the first time since 2008, they did not confirm the continuation of the rate cut in the coming months, and what happened was an update to the monetary policy cycle, and the bank will continue monitoring economic developments to decide on the appropriate monetary policy. At the same time, the Bank does not heed the continued criticism of Trump of the Bank's policy, which is characterized by being hawkish.

Factors for gold's continued gains remain strong, including no-deal Brexit fears - growing global trade tensions - slowing global economic growth - tension in the Middle East - without which gold could lose all of its recent record gains.

Technically: Gold prices today will strengthen upwards if it moves towards the 1500 psychological top, which is currently closest to it, and testing it will determine new resistance levels. On the downside, the nearest gold support levels are currently 1479, 1465 and 1450 respectively. I still prefer to buy gold from every bearish level.

On the economic data front: Gold reacted strongly today with the announcement of a stronger than expected cut in the New Zealand interest rates. After that there are no significant data affecting gold today.