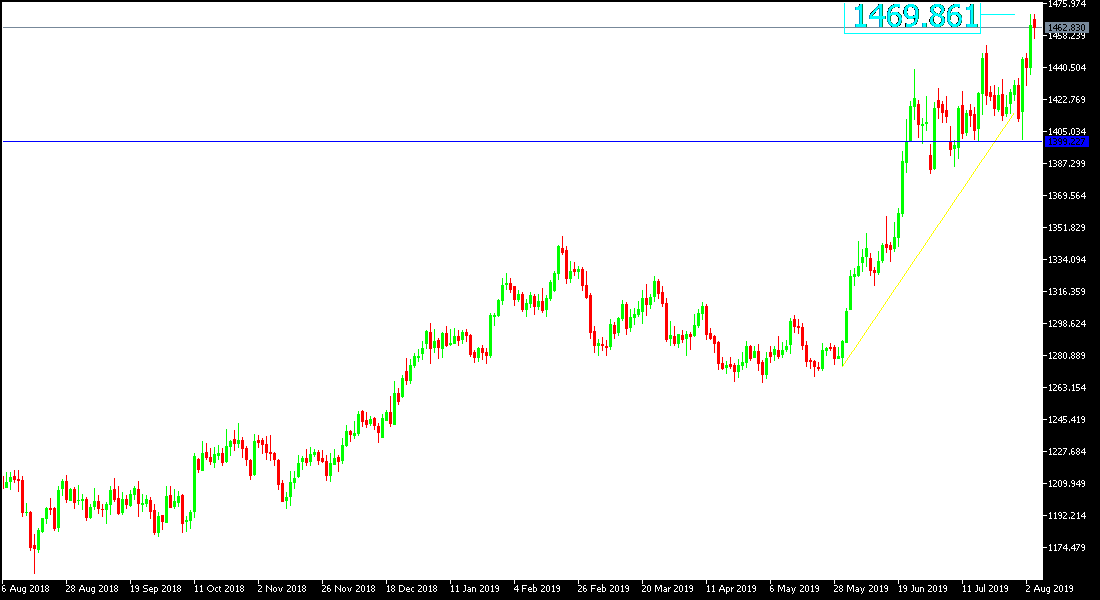

For four straight trading sessions, the gold price recorded stronger gains, testing the $1,470 resistance level of in morning trades on Tuesday, despite recent gains in the US dollar. The yellow metal has ignored that, as it received stronger support from continuing global trade and geopolitical tensions, led by the imposition of new US tariffs on Chinese imports and the failure of recent round of trade talks between the two sides of the global trade war. The retaliatory response from China to devalue the Yuan pushed it to its lowest level in a decade to hit US export competitiveness on world markets. China's move was considered by the United States as a declaration of a currency war.

In recent economic news, the US jobs report showed mixed results, but the Federal Reserve and economists remain confident of the strength of the US labor market. Before that, the Federal Reserve cut interest rates for the first time since 2008 and did not confirm the continuation of the pace of rate reduction in the coming months, but reiterated that it will monitor economic developments to determine the appropriate monetary policy.

The fundamentals that support the continuation of gold gains are still in place. No-deal Brexit fears - Global trade tensions led by the United States and China - slowing world economic growth - the worsening situation in the Middle East – all will further boost the buying of gold to hedge against those risks.

Technically: Today's gold prices continue to hold on gains despite the testing of technical indicators for overbought areas, and we continue to confirm that gold has the opportunity to test stronger tops. Resistance levels 1462, 1475 and 1490 may be the nearest targets to support that move towards psychological resistance of $ 1500 an ounce. On the downside, the nearest support levels for gold are currently 1455, 1448 and 1435, respectively. Overall we still confirm the recommendation to buy gold from every low level.

On the economic data front: Gold will react only with investors’ fears as global trade and geopolitical tensions continue.