It was natural that the gold price was strongly bullish in early trading today after the dramatic events at the end of last week's trading. The price rose to $1,555 in the first minutes of this week, the highest gold since April 2013, before settling down to $1540 at the time of writing. The upward price gap was supported by increased trade tensions between the world's two largest economies, as China imposed more tariffs on US products. The immediate response came from the US president, who approved tariffs on China's imports. After China's move, the White House said Trump expressed regret that he didn’t impose full tariffs on all Chinese products. Gold's gains were stalled after China's vice premier said Beijing wanted to negotiate quietly with the United States to end their trade dispute and did not want to ignite any further. The official is the chief trade negotiator with US negotiators.

At a symposium in Jackson Hole, Federal Reserve Governor Jerome Powell said Friday that the Fed will continue to monitor economic developments and mounting global risks to determine appropriate monetary policy amid total disregard for recent criticism from US President Trump's policy and that they are hindering his economic plans. Prior to that, the minutes of the last Fed meeting showed a clear split among the members of the Federal Reserve on the amount and timing of the US rate cut, some of whom felt that the cut should not take place until there are negative and continuous developments on the good performance of the US economy.

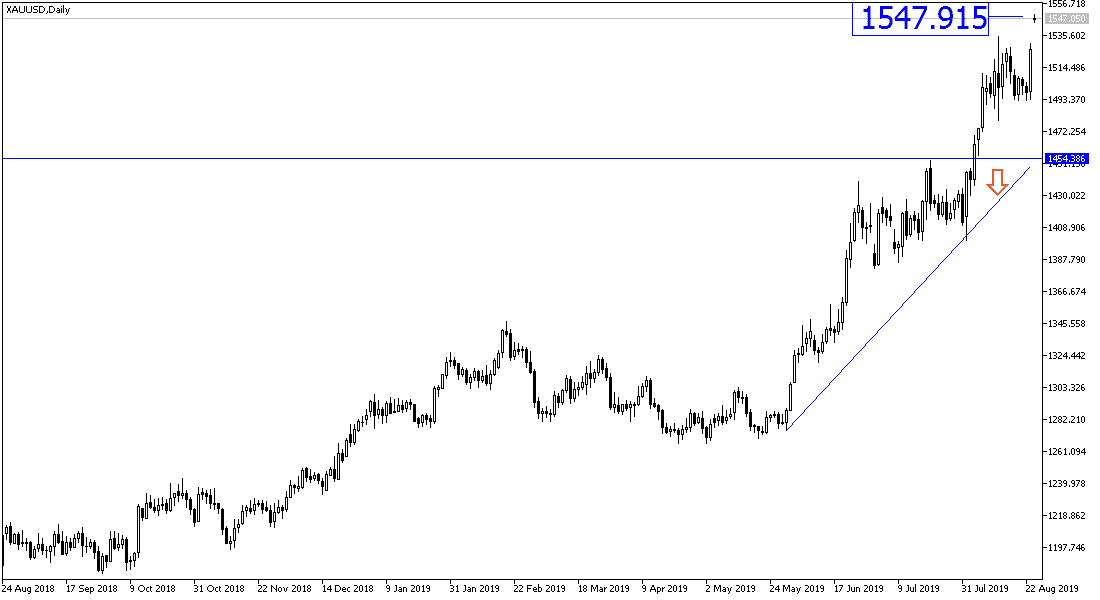

According to the technical analysis of gold: the general trend of the gold price will remain strongly upward as long as it is stable above the $1500 psychological resistance, and as we mentioned in recent technical analysis, the stability above will support the test of stronger record levels and reached all the peaks we expected. Currently, the closest resistance levels after the recent momentum are 1560, 1577 and 1585 respectively. Continued gains may support profit taking at any time as technical indicators have reached strong overbought areas and if this happens, the nearest support levels for gold will be 1535, 1520 and 1500 respectively. Continued global trade and geopolitical tensions will continue to support gold purchases.

On the economic data front, today's economic calendar will focus on the release of the German IFO Business Climate Index. From the United States of America, durable goods orders figures will be announced.