Gold price was little affected by the release of the Fed Reserve Minutes’ contents for July meeting. Gold price remained stable above the $1500 psychological resistance and reached $1508, and is also stable around that level at the beginning of Thursday’s trading. The contents of the minutes did not provide any hints for the continued pace of US rate cuts. The rate cut was described as a wise move from a risk management perspective, as risks and uncertainties associated with global economic outlook and international trade remained high. The Fed highlighted its concerns about inflation expectations, with a number of participants at the meeting noting that inflation continued to fall below the central bank's 2% target.

Two members of the bank's policy committee favored a 50-basis point rate cut, preferring stronger measures to address weak inflation, the minutes noted. Kansas City Fed President Esther George and Boston Fed Chairman Eric Rosengren voted to leave rates unchanged. The Fed is scheduled to hold its next monetary policy meeting on Sept. 17-18, with a 98% expectation that the central bank will cut interest rates by another 25 basis points.

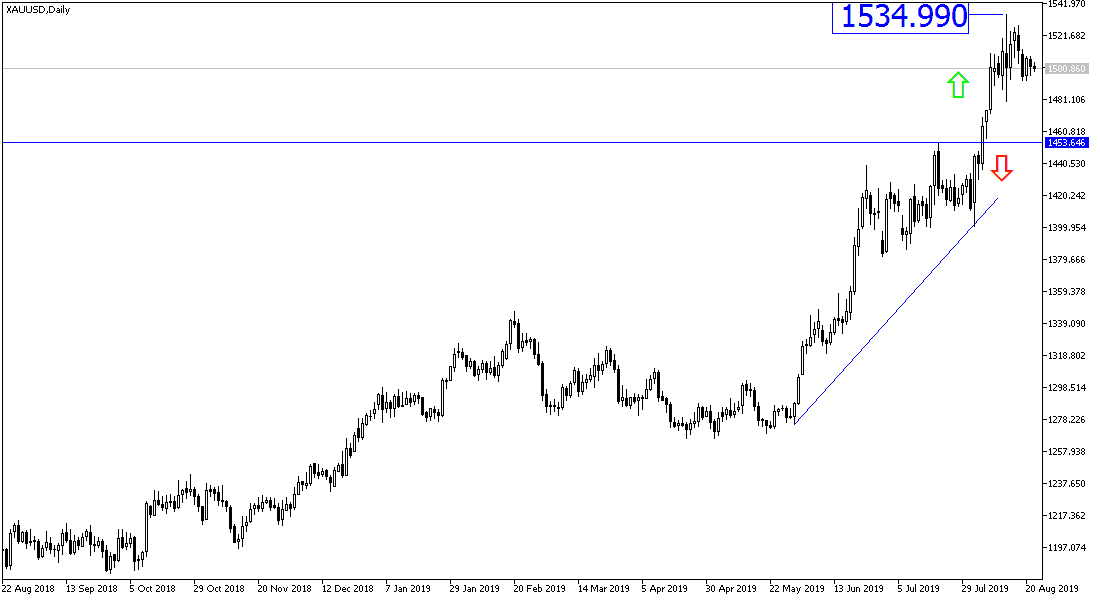

According to the technical analysis of gold: The general trend of the price of an ounce of gold is still rising, supported by stability around the highest psychological resistance level of $1500. Renewed buying will support the price of gold towards resistance levels at 1515, 1525 and 1540 dollars. In case of a downward correction, support levels of 1492, 1484 and 1470 will be stronger, from which investors may seriously consider buying and going higher.

On the economic data front, the economic calendar will focus on the release of PMIs for the manufacturing and services sectors of the Eurozone economies. From the United States, there will be an announcement of unemployed claims. From Monday to the end of this week's trading, gold will focus on comments from global central bankers at the Jackson Hole seminar, and the renewed global trade and geopolitical tensions, which provide a strong impetus to the yellow metal as one of the most important safe havens.