Despite the decline in the price of gold to the $1493 support level during Tuesday's trading session and because the incentives for its gains still stands; prices returned to stability above the $1500 psychological resistance again to $ 1508 at the time of writing the analysis and before the announcement of the contents of the last meeting of the Federal Reserve. This has a strong and direct impact on the performance of the US dollar, and thus on the price of gold, as the relationship between them is inverse. The recent moves of gold, supported by profit-taking selling, as investors took risks and the administration hinted at the possibility of introducing new tax cuts to stimulate the world's largest economy. The Trump administration is seeking to do so as the US central bank sticks to its monetary policy and ignores the ongoing attack by Trump to aggressively cut interest rates as other global central banks do. The Federal Reserve focuses on economic developments to determine the right course for its policy and pays no attention to Trump and his remarks.

Markets are also awaiting Jerome Powell's remarks at the Jackson Hole symposium, which is organized by the bank and includes officials from other international central banks. Investors want strong and uncertain signals about the future of the Fed policy. In general, the US-China tariff war and its negative impact on global economic growth, the persistence of the Brexit crisis, global trade and geopolitical tensions in general, will continue to support the continued gains of gold, because the yellow metal is one of the most important safe havens for investors in times of uncertainty.

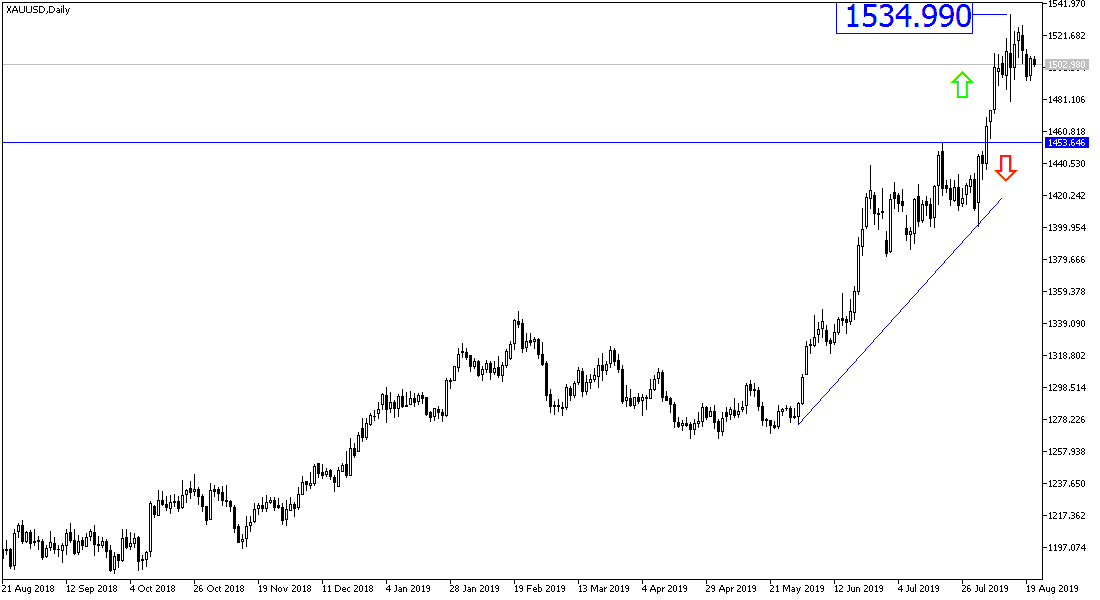

According to the technical analysis, the price of gold holding at the $ 1500 psychological peak will continue to support the strength of the uptrend, and may experience higher resistance levels could reach 1515, 1527 and 1540 respectively. At the moment, investors are looking for 1490, 1482 and 1475support levels to return to buy gold again. Gain factors remain as is, and on the daily chart, the price of gold is still floating within an ascending channel. I still recommend buying gold from every bearish level.

On the economic data front, the economic calendar today will focus on the release of the minutes of the last meeting of the US Federal Reserve.