Gold markets went back and forth during the trading session on Tuesday as we continue to see a lot of volatility. The $1500 level of course has attracted a lot of attention, as we have used it as both resistance and support recently. That being said though, I think that the market is likely to pull back a bit from here, as the United States has offered to delay tariffs on Chinese goods.

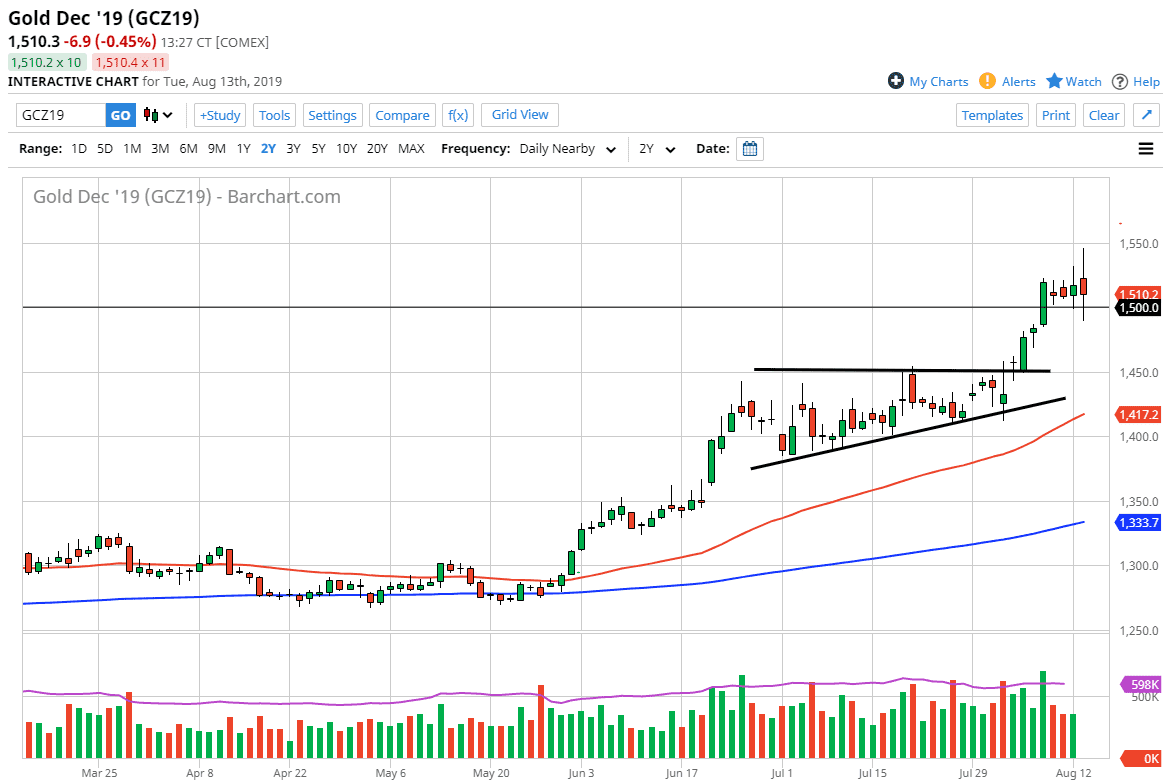

This had a little bit of a “risk on” type situation, and gold of course sold off as equities climbed. That being said, nothing really has changed for the big picture, so I think that a break down from here makes quite a bit of sense as we have perhaps gotten a little bit extended. I see the $1500 level as potential support, but if we were to break down below the lows of the trading session on Tuesday, then I’d be looking to buy the dips closer to the $1450 level. That is the top of the ascending triangle that I have marked on the chart, which is now starting to attract the 50 day EMA. Because of this, I it’s only a matter of time before we turn around and rally from that area.

The candlestick for the trading session is a sign of just how confused the markets are, and as a result I think that you should probably look for value on pullbacks as an opportunity. I’m looking for gold to offer an opportunity as we are most certainly in an uptrend, and even though we have got a little bit ahead of ourselves, I’m not willing to fight this massive move. I also recognize that there is an alternate scenario possible.

We could try to break above the $1550 level, and if we do then I think we go much higher, perhaps reaching towards the $1600 level. I still believe that gold has much higher to go, possibly even as high as $1800 or even $2000. It’s going to take quite a bit of effort, but I do believe it’s only a matter time before the buyers take over again. But frankly, I have no interest in shorting this market, but I would have to rethink the entire situation if we had a daily close below the red 50 day EMA which is currently just above the $1400 level.