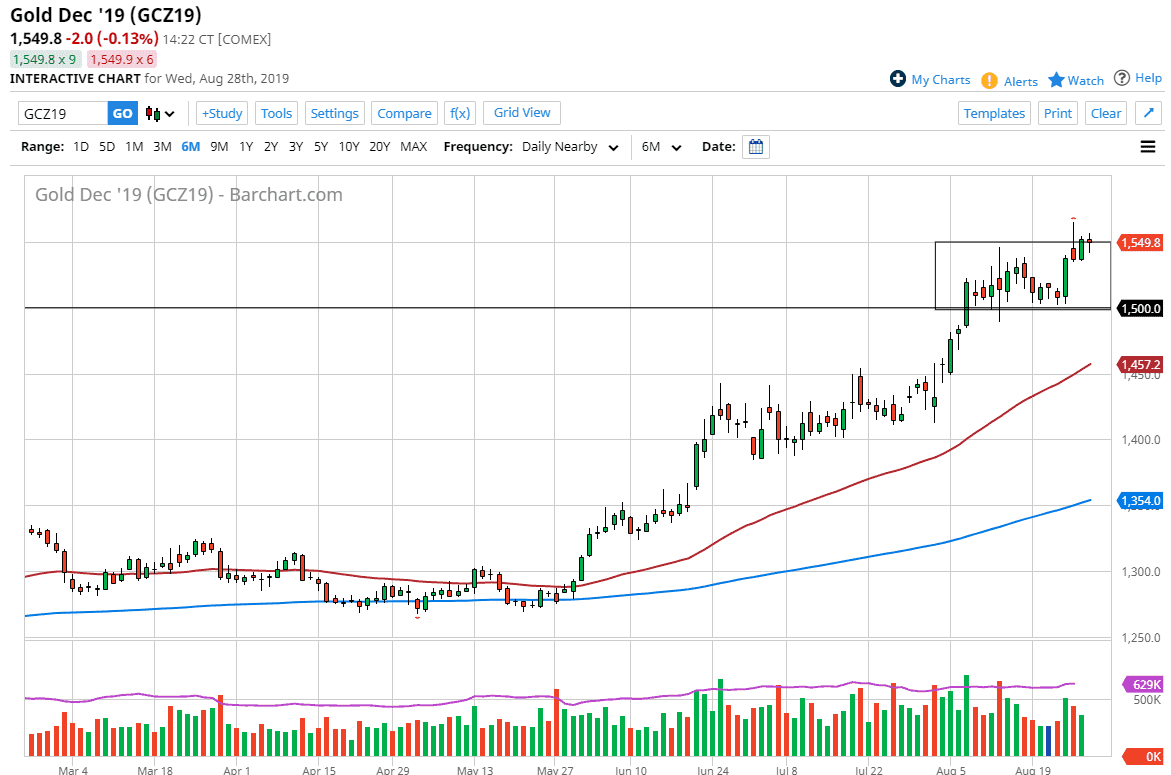

Gold markets have gone back and forth during the trading session on Wednesday as we continue to dance around the $1550 level. This is a market that continues to be very bullish longer-term, so therefore I think that short-term pullbacks are going to be the best way to go forward in this market. The $1500 level underneath is important from a longer-term standpoint, as it is a large, round, psychologically significant figure. It’s also an area where we have seen buyers come back into the marketplace, so I think that pullbacks are certainly the way to go.

The candle stick is a bit neutral, but I do think that we are overdone. If we can break above the Monday candle stick though, it would be more of a “blow off top” than anything else, allowing the market to go towards the $1600 level. Short-term pullbacks offer buying opportunities in a market that is obviously bullish. Gold will continue to attract a lot of attention as there are a lot of concerns out there from a geopolitical and macroeconomic standpoint, not the least of which of course is the US/China trade tensions that continue to get worse.

Looking at the chart, if we do break down below the $1490 level, the market is likely to go down to the 50 day EMA underneath. That should offer plenty of support, so I think at this point it’s likely that we will have more than enough reasons to go long on any pullback. Being overdone is one thing, but it is simply an opportunity that you should take advantage of in think a pullbacks as “value” in an asset that is highly prized.

Longer-term, I believe that this market is going to go looking towards the $1800 level and then eventually the $2000 level. Central banks around the world continue to cut interest rates and ease monetary policy which is the perfect formula for precious metals to rally. Gold of course is the first place that money goes, but we also have silver and platinum doing quite well in this scenario as well. I believe the precious metals are to be bought and not sold, so that’s how I’m going to trade this market over the longer-term. I have no scenario in which I am willing to sell this market anytime soon, and I think that will continue to be the case for the remainder of the year.