The Gold markets initially gapped higher to kick off the trading session on Tuesday after the Americans named the Chinese “currency manipulators”, while the futures markets were closed. With that being said, as soon as the Globex came online, the flush of orders came in to pick up gold as a safety bid came back into the markets.

A few hours later, the Chinese assured foreign firms that the Chinese yuan was going to be stabilize and chose not to escalate the trade war. By doing so, and seeing the Chinese yuan slow down, we got a bit of a breather to the market and ended up seeing the Gold markets pull back. A little later on in the day, we have turned around to form a bit of a hammer. This is a market that is extraordinarily bullish so none of this action should have been a surprise, just the reasons why it occurred.

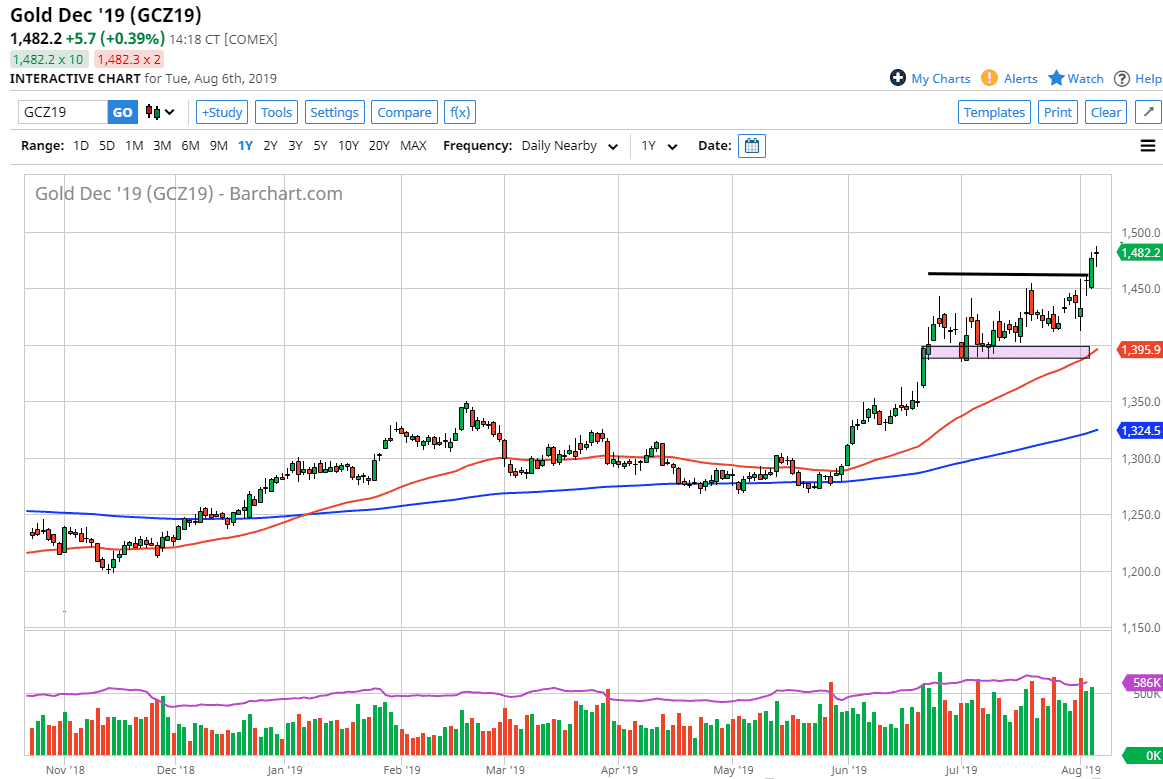

When you look at the chart, you can see that we had been consolidating but then broke out to the upside over the last couple of days. I believe that the $1450 level will offer support, just as the $1425 will be. The 50 day EMA is starting to slice through the $1400 level. In other words, I believe that is the absolute “floor” of the market. Overall, I recognize that we are looking at a slightly overbought condition, but the $1500 level above will probably cause quite a bit of resistance. I don’t know that $1500 will be massive structural resistance, but most certainly will be massive psychological resistance.

The alternate scenario of course is that we break down through the bottom of the hammer like candle from the Tuesday session. That ends up turning it into a so-called “hanging man”, which is very bearish. At that point I think we go looking towards the gap underneath, which is right around the $1425 region. I don’t like shorting gold, so I think that if we pull back to that level is a nice opportunity as well. With that in mind, I have no interest in shorting and I think that this market will only go higher due to not only the technical analysis, but the fact that central banks around the world continue to loosen monetary policy, which of course drives up the demand for so-called “hard money.” Obviously, precious metals do quite well in that scenario.