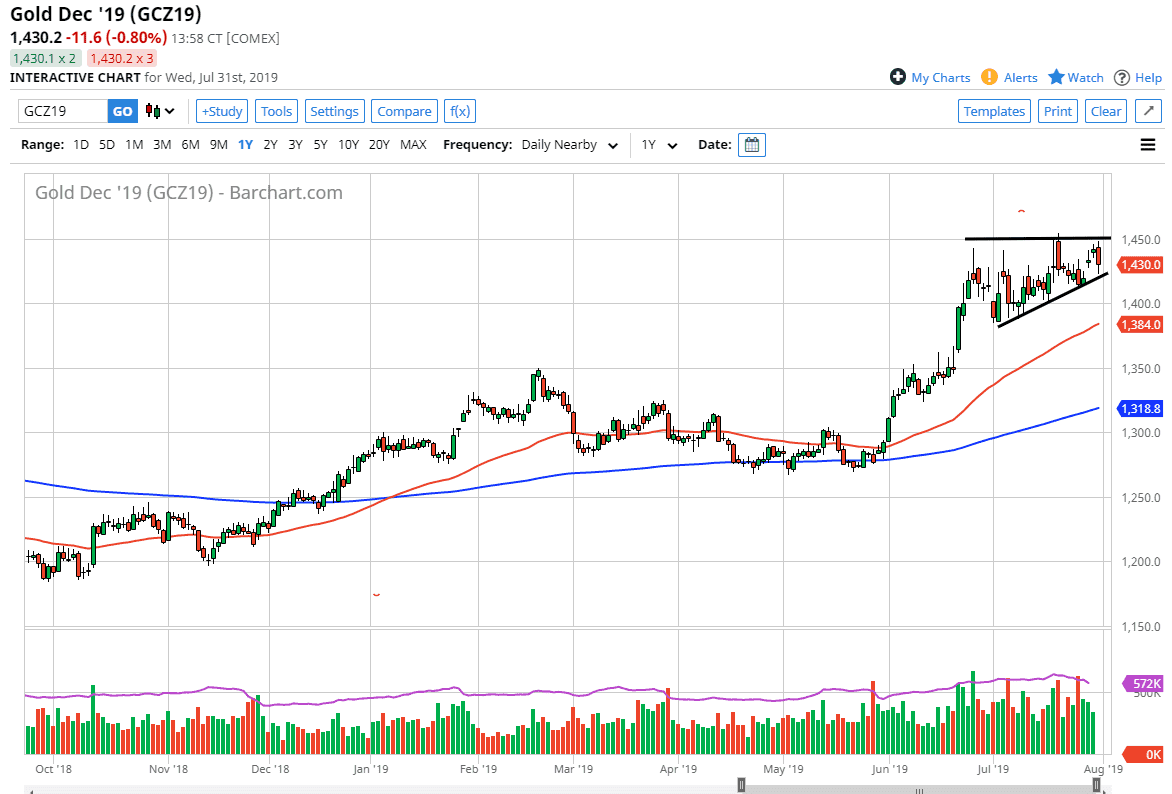

Gold markets fell rather hard after the interest rate announcement and even leading into it on Wednesday but have found support at a crucial level underneath. As you can see on the chart, I have a bit of an ascending triangle drawn, and we have bounced from that uptrend line to show signs of life again. Ultimately, I think this is a market that continues to go to the upside and looking to break out above the psychologically and crucially important $1450 level. That’s a level that if we can break above, we could really start to take off to the upside.

Looking at the gold market, it has been grinding higher for some time due to a lot of economic concerns and of course the idea that the Federal Reserve has cut its rates. Whether or not it will continue to cut is still up for debate, but it does seem as if the market is looking for a bit of safety at this point. If we do break above that $1450 level at the $1500 level should offer a lot of psychological and perhaps structural resistance. Breaking above there of course opens the floodgates for more money to come into the market, perhaps trying to pick up on the momentum.

To the downside, if we were to break down below the uptrend line that could signal that we are going to go lower. Having said that, I believe that the $1400 level is the beginning of massive support down to the $1390 level, which also has the 50 day EMA heading into that area. Because of this, it’s likely that we could see the market bounce hard from that level. If we were to get a break below that level though, that could change the overall attitude of this market. Longer-term, I believe that with central banks around the world cutting rates, the precious metals markets should get a bit of a lift regardless. The Federal Reserve cutting rates was already known, but it’s not as if they have put on a very dovish statement afterwards. That could be the one chink in the armor when it comes to gold, but at this point there are enough central banks out there looking dovish to keep this market going higher. At this point I believe that short-term pullbacks continue to offer nice buying opportunities that you should be taken advantage of.