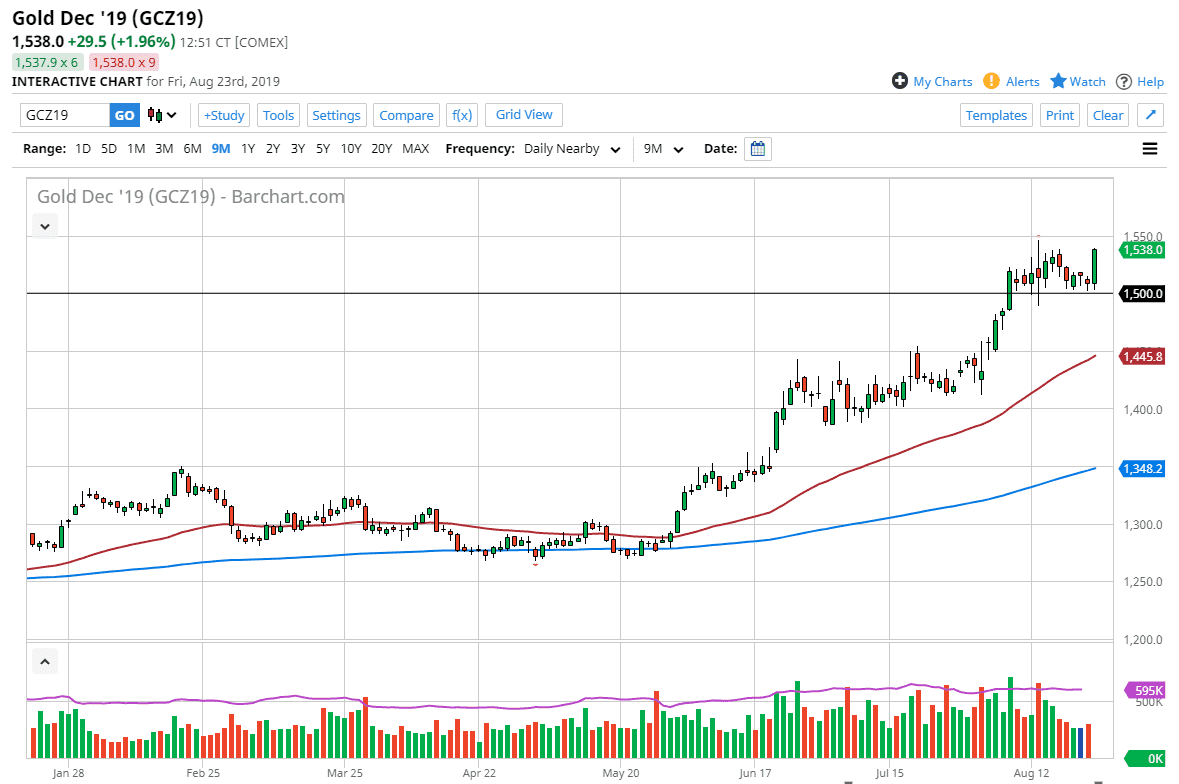

Gold markets initially dipped a little bit during the trading session on Friday, reaching down towards the $1500 level. However, we found enough buyers in that general vicinity to turn this market around and it eventually exploded to the upside. Jerome Powell had a speech during the trading session, and it appears that traders are starting to think that the Federal Reserve is going to facilitate lower interest rates. At this point, the market certainly is bullish, so I think it’s obvious that a pullback should offer some type of value the people are willing to take advantage of, and that’s exactly how I would be trading this market.

Obviously, the $1500 level continues to be support and I think that it extends down to the $1490 level, as it is more of a “zone” than anything else. Think of it is your short-term floor in the market. However, there is also the ascending triangle underneath which had a top at the $1450 level. We are now starting to see the 50 day EMA cross that level, so if we did break down that would be the ultimate “floor in the market”, and something that should be paid attention to. I would love to buy gold down at that area but I don’t think we’re going to get that opportunity.

With central banks around the world likely to continue the loose monetary policy, it’s likely that we will eventually find buyers regardless of what happens next. If we can break above the $1550 level, the market then probably goes looking towards the $1600 level as gold tends to move in $50 increments. One thing that I do like the idea about buying dips is that we are closing towards the top of the candle stick for the day, showing real potential conviction behind the gold trade, and why not?

I look to buy dips, I also looked at by breakouts but I do recognize that we are a bit extended at this point. I would like to see some type of opportunity to pick up a bit of value (honestly, who wouldn’t?). If I don’t get that opportunity, then I have to be long of this market above the $1550 level. At this point, I like the idea of goal going closer to the $2000 level over the next several months.