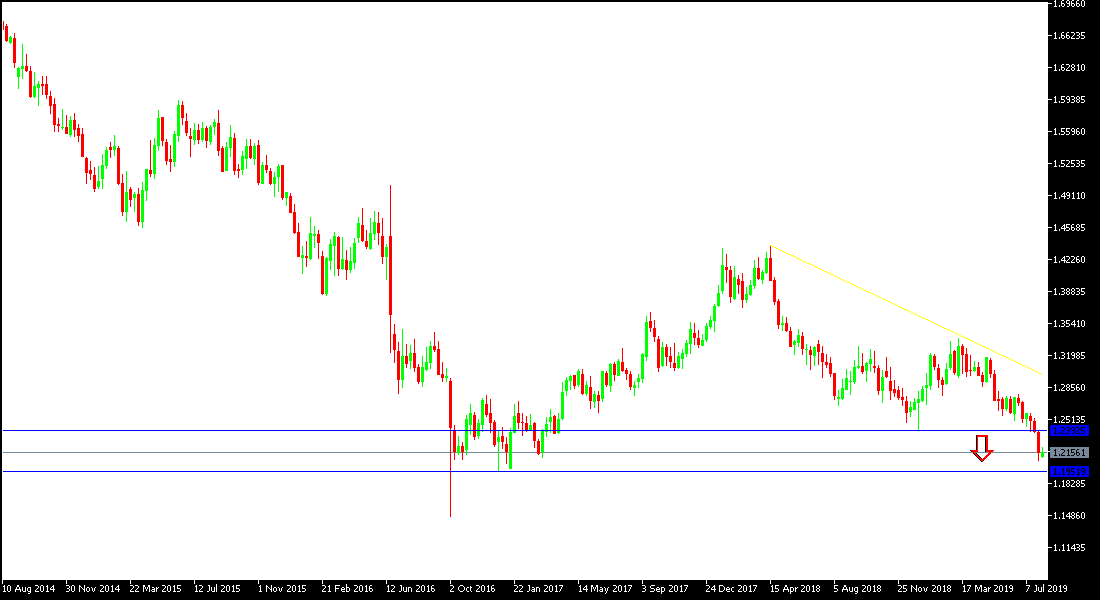

On the daily chart, the GBP / USD pair is showing a weak performance as the pair trades between the 1.2101 support and the 1.2209 resistance, and is stable around 1.2154 at the time of writing. This performance is normal with the scarcity of US and British economic data affecting the direction of the pair. Overall, it is still moving within a record bearish channel that recently pushed it towards the 1.2080 support level, its lowest level in 28 months. Divergent economic performance and monetary policy between the United States and Britain will favor the continuation of the bearish trend for the pair. The US Federal Reserve has cut US interest rates for the first time since 2008. In its monetary policy statement, they stressed that the bank has not completely shifted its policy toward more rate cuts. As for the Bank of England, while keeping interest rates unchanged, they expressed pessimism about the future of Britain's economy if it were to leave the EU without an agreement. Led by Carney, the bank cut its outlook for the country's economic growth and warned of a possible recession, due to uncertainties linked to Brexit, slowing global economic growth and growing global trade disputes.

Financial markets want action on the ground from the new British government led by Boris Johnson to resolve the problem of a no-deal Brexit. That government has so far not officially announced any move, which has supported expectations that Boris Johnson, as expected before his nomination, will lead the country out of the EU in any situation, even if it was without agreement.

Technically: GBP / USD remains bearish and moving below 1.2100 and 1.2000 support means the pair is paving the way to test new record support levels. On the upside, the closest resistance levels are currently at 1.2235, 1.2300 and 1.2385, respectively, as we expected before, we now confirm that a move higher would be a good opportunity for traders to return to sell the pair again. The uncertainties around Brexit still causing a constant pressure card for any gains in the Pound.

On the economic data front: Today's economic calendar has no significant data from the United States or Britain.