The performance of the pound against major currencies will interact with the announcement of the Bank of England announcement of its monetary policy amid expectations that the bank will maintain its monetary policy unchanged at 0.75% interest rate. Also an asset purchase plan, which is estimated at 435 billion pounds, with the consensus of bank policy members. The bank will not be affected by the appointment of the new British Prime Minister, Boris Johnson, but on the contrary it will increase the Bank's fears of its appointment, because the new official is ready to leave the EU without an agreement and prepares contingency plans to counter that. This has brought more record losses to the Pound as the GBP/USD dropped to 1.2100 support level in early tradings today, the lowest level in 28 months.

The US dollar gained strongly after the US Federal Reserve announced its interest rates cut for the first time since 2008 and indicated that the rate cut will not be followed by the bank's future policy, and that the cut was merely an update for the bank’s monetary policy. The bank’s chairman stressed that cutting interest rates is not going to be the bank's new system will be from now on. The bank and its members renewed their confidence in the performance of the US economy. Data received since the last meeting indicate that the labor market remains strong and economic activity has risen at a moderate rate. At the same time, the Fed said it would continue to monitor the implications of the information on the economic outlook and would act "as necessary to maintain expansion".

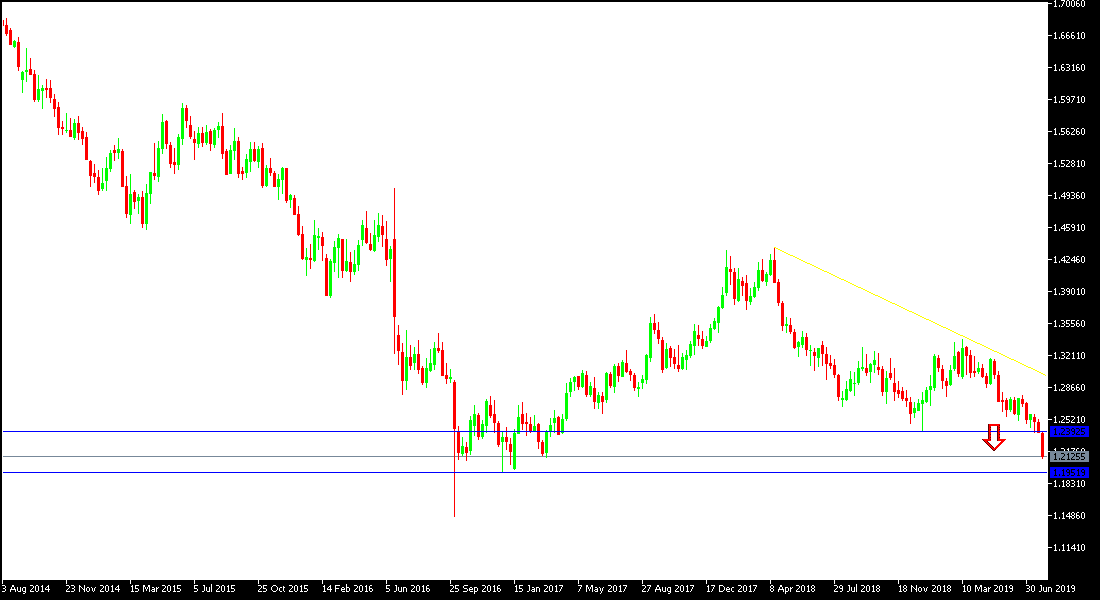

Technical Analysis: The overall trend of the GBP / USD is bearish as we expected in our technical analysis, and is closer to our first target of 1.2000 psychological support, and as we test it, we will update the pair's next support targets. For the bullish correction, we have not seen any signs of near correction, even though all technical indicators have reached strong oversold levels. We still prefer to sell the GBP/USD pair from every rising level. The pound remains under threat from the future of the Brexit.

On the economic data front: today's economic calendar will focus first on the announcement of the Bank of England on the monetary policy and the press conference of the Bank of England Governor. From the United States, there will be announcements for unemployment claims, ISM manufacturing PMI and construction spending data.