The GBP/USD performance today will be driven by the UK jobs and wages data and then the US inflation numbers. The pair is trying hard to stay away from the 1.2000 psychological support so that the bearish pressure does not increase and then the pair faces stronger sell outs. The BOE fears were confirmed, as it was announced that the UK economy contracted to its lowest level in 6 years in Q2 of the current year, and may get into a full recession if the UK were to leave the EU without a deal. With Boris Jonson winning the PM seat at the UK, investors are now more convinced of that result. Official Brexit deadline is on October 31st.

In the U.S, international banks and institutions continue to issue their bleak outlooks for the U.S economy and the Fed Reserve’s policy in the coming months. Recently, outlooks from Morgan Stanly, and before that from Goldman Sacks, showed that the continuation of the US/China trade dispute would surly lead to an economic recession for the world largest economy, which might push the Fed Reserve to lower interest rates quickly. The nearest opportunity would be the bank’s meetings on September and October, and would increase the cut pace in 2020, especially if Trump would win another presidential term, as he threatens to impose more pressures on China to accept the US policy first if they wish to end their trade war.

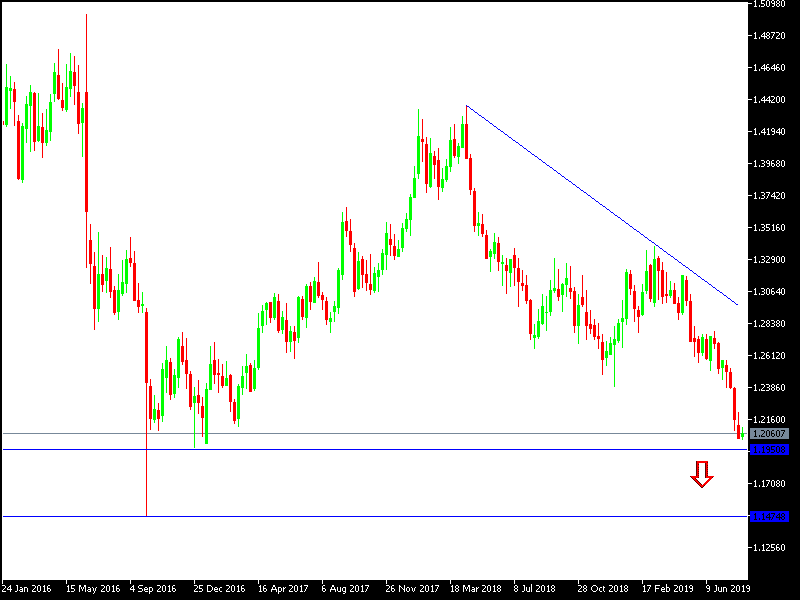

Technically: The GBP/USD breaking through the 1.2000 psychological support might support strong selling for the pair, pushing it to test stronger support levels at 1.1925, 1.1800 and 1.1760 respectively, which are levels supporting the bearish trend, and are not hard goals especially with continues Brexit fears. In case of a bullish correction, the pair might target resistance at 1.2120, 1.2200 and 1.2310. I still prefer to sell this pair from every bullish level. Technical indicators reaching oversold areas didn’t stop investors from selling the GBP.

On the economic data front: Economic agenda will focus today on the UK Jobs and wages data, with expectations suggesting an increase in the wages average and unemployed claims, with a steady unemployment rate. From the U.S, there will be an announcement of the CPI data, inflation is still away from the Fed Reserve’s goal.