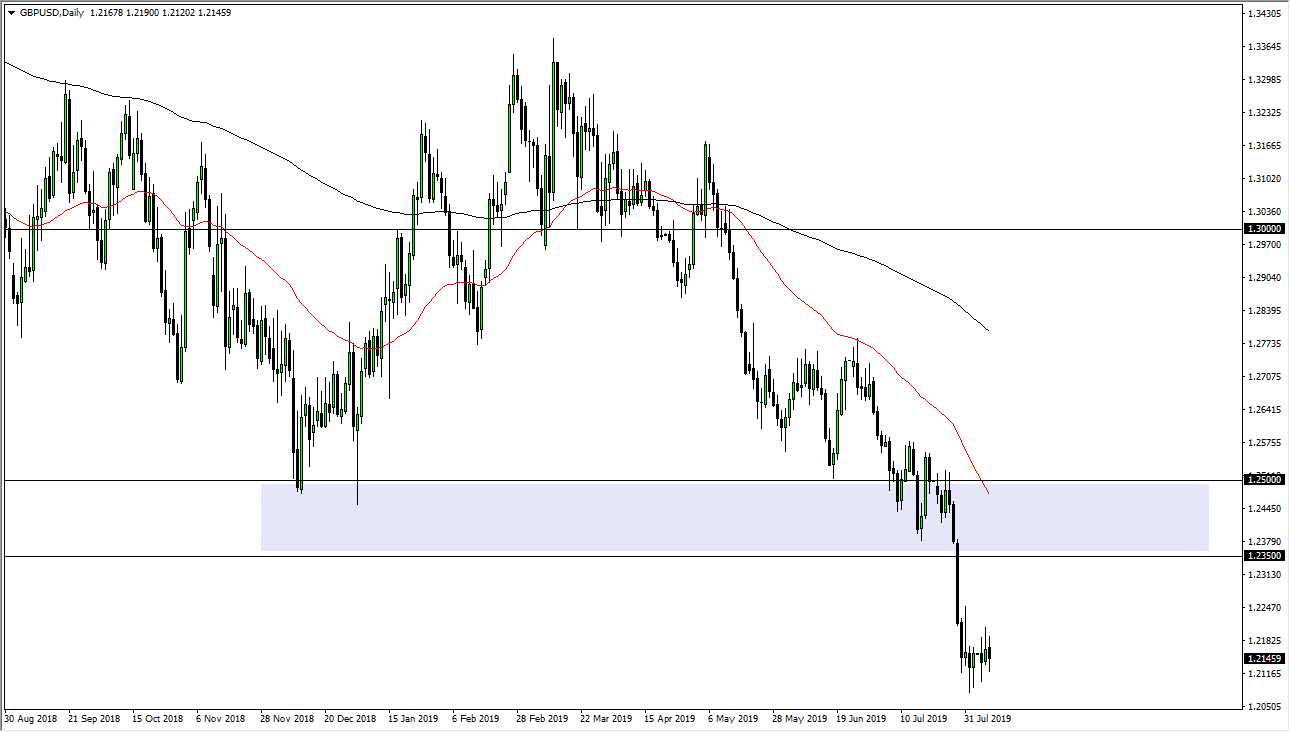

With the lack of economic data and events since the beginning of this week's trading, it was normal for the GBP / USD pair to consolidate during the last trading sessions between the 1.2100 support level and the 1.2190 level of before settling around 1.2176 at the time of writing. Last week, it tested the 1.2080 support level, the 28-month low. On the daily chart the pair seems to be holding steady, foreshadowing a strong move in either direction, which is, closer to the downside, as Brexit uncertainty continues to dominate. Expectations are growing that the country is on its way out on schedule on 31st of October, but without a trade and political deal between the two sides, which could increase pressure on the British economy and the Pound exchange rate.

By the end of this week, the pair will be on an important date with the release of a package of important UK economic data, mainly GDP, manufacturing production and business investment rate. Also from the US, an important release will be the PPI, which is an inflation gauge of the country. In general, the mixed economic performance and monetary policy between the United States and Britain will favor the continuation of the bearish trend for this pair. The US central bank cut US interest rates for the first time since 2008. The Bank of England has been further pessimistic about the future of Britain's economy if it leaves the EU without an agreement. They recently lowered their forecast for the country's economic growth and warned of a possible recession, due to uncertainties associated with Brexit and the global trade war.

Technically: GBP / USD is still supporting the downside and testing new record support levels especially if it moves towards the support areas at 1.2100 and 1.2000 respectively. In case of a correction to the upside, the nearest resistance levels will be 1.2235, 1.2300 and 1.2385 respectively. Brexit is still causing a constant pressure for any gains in the Pound.

On the economic data front: Today's economic calendar has no significant UK data. There is only the United States of America's weekly jobless claims.