Major currencies are trying to offset their recent losses against the strength of the US dollar. However, GBP / USD's attempts were not strong as the pair rebounded to 1.2183 at the time of writing. At the end of last week's trading, the pair reached the 1.2080 support level, its lowest in 28 months. Expectations of a hard Brexit are preventing Sterling from correcting strongly. Given this difficult situation, the Bank of England had to express pessimism about the future of the country's economy in the event that the a no-deal Brexit. As a result, the Bank reduced its forecast for economic growth and warned of a possible recession due to uncertainties associated with Brexit, slowing world economic growth and expanding global trade disputes.

For the US economy, we saw a divergence in official US job numbers for July. Before that, the US Federal Reserve has cut US interest rates for the first time since 2008. In a statement of the bank monetary policy, Governor Powell said at the press conference that the bank had not completely shifted its policy towards further rate cuts. At the beginning of this week, the growth of US utility businesses was reported to be at its lowest level in nearly three years, with weak measures for business and new orders. The ISM Non-Manufacturing Index fell to 53.7 from 55.1 in June. July's growth was the weakest for the sector since August 2016. Readings higher than 50 indicate expansion, and the services sector represents the bulk of jobs and economic activity in the United States.

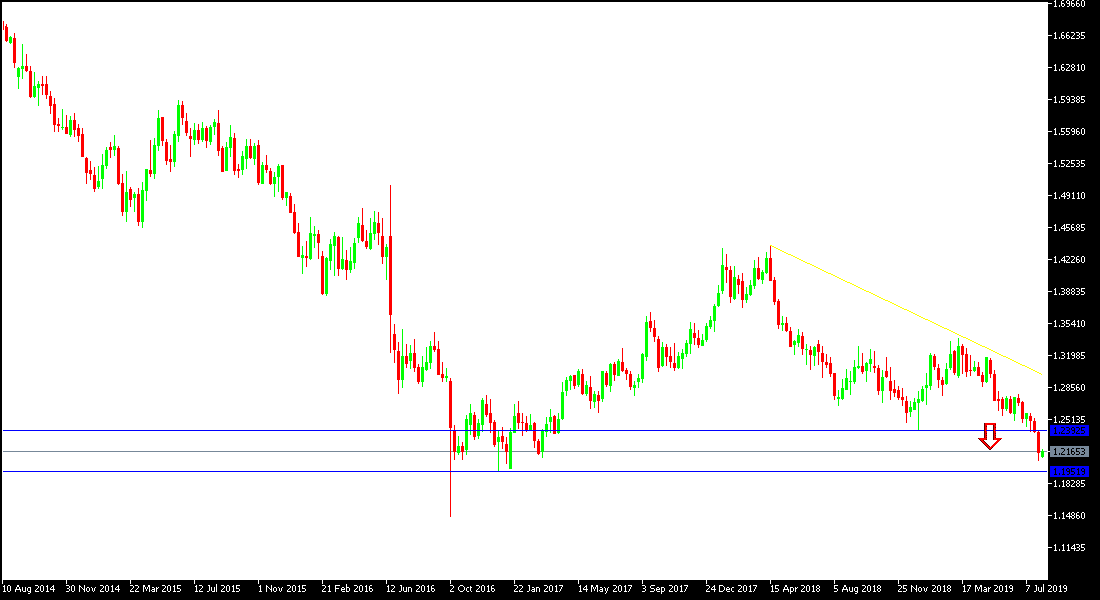

Technical analysis: GBP / USD gains will remain good selling opportunities again, as the uncertainties around Brexit will continue to cause pressure on any gains for the GBP. The pair's current resistance levels are 1.2230, 1.2300 and 1.2385, respectively. On the downside, the pair remains vulnerable to test of record and historical support levels as soon as possible, with the nearest support areas are currently 1.2120, 1.2040 and 1.1980 respectively, which are consolidating the strength of the current bearish trend.

On the economic data front: The economic calendar today is free of any important and influential data from the United States or the UK.