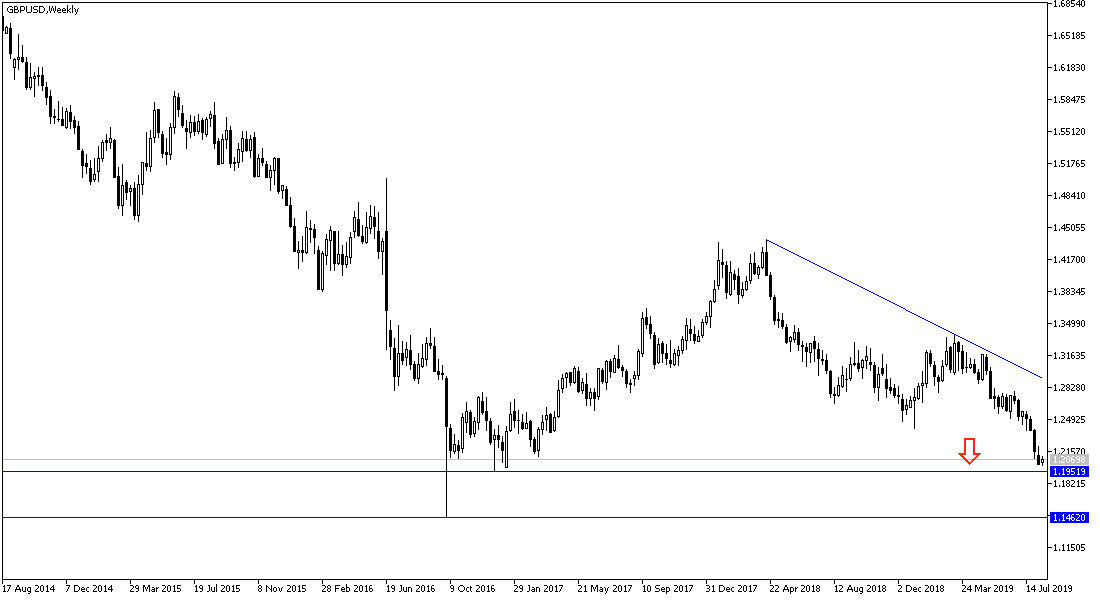

Since the beginning of this week, the performance of the GBP / USD pair frustrated Forex traders, as the pair is in narrow ranges amid downward momentum on the threshold of 1.2000 psychological support. Attempts to rebound did not exceed the 1.2100 resistance, and at the same time, trying hard not to penetrate the 1.2000 psychological support to avoid increase selloffs, and testing new record support levels. Positive jobs and wage numbers, and then rising British inflation levels, did not provide momentum for the pair to correct higher. Contrary to the current situation, the results would have pushed the Pound strongly for gains, but the situation now is different. The Brexit crisis has not been solved and there is no sign of any agreement between the parties, and a no-deal Brexit without would be disastrous for the British economy and the pound exchange rate.

Signs of weakness from a no-deal Brexit began to emerge with the announcement that the British economy contracted to its lowest level in six years in the Q2 of 2019, as well as the pessimistic expectations from the Bank of England of the country's economy to enter into recession if the Kingdom exits the EU without agreement. British Prime Minister Boris Johnson is determined to do so, and prepares contingency plans before going out on Oct. 31.

US-China trade war: Further tariffs on Chinese products postponed to December 15, 2019. Financial markets considered the US decision that it could not enter into a currency war with China after the latter devalued the Yuan against the dollar to an 11-year low. Also, recent fears that the US economy could enter into recession in the coming months if the trade dispute with China continues, has eased.

Technically: the GBP / USD's breach of 1.2000 psychological support will increase the selling and may test stronger support levels at 1.1925, 1.1800 and 1.1760 respectively. In case of a bullish correction, the nearest resistance levels are currently at 1.2120, 1.2200 and 1.2310 respectively and I still prefer to sell the pair from every bullish level.

On the economic data front: The pair will react first with the release of the UK retail sales figures. During the US session, there will be a batch of data announcements, led by retail sales, the Philadelphia Industrial Index, non-farm productivity, jobless claims and industrial production.