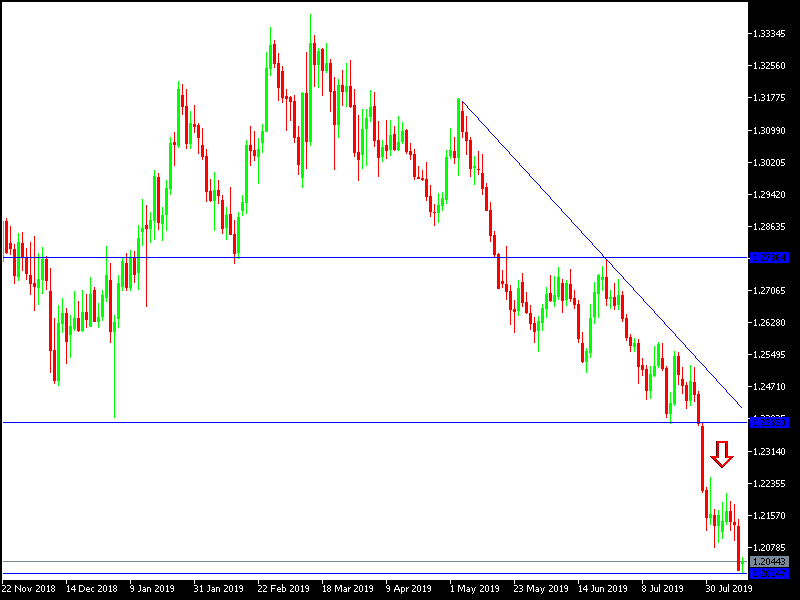

The British economy shrank to its lowest level in six years in the second quarter, adding to expectations that the British economy could be hit by a severe recession if the country leaves the EU without an agreement. GBP/USD continued its decline to the 1.2014support level, which was reached at the beginning of this week, and the lowest level in 28 months. Since Boris Johnson won the British premiership, expectations have been growing that the country is on its way out of the EU without an agreement, and there has been no change from both sides to the official exit date set for Oct. 31.

On the US level, the US-China trade war is still at its peak, with each party sticking to their demands, pushing the US to impose more tariffs on Chinese products, and the Chinese responded by stopping the purchase of US agricultural products, and interfering with the Yuan exchange rate, bringing it down to an 11-year low against the USD, to hit US export competitiveness on world markets. The latest decision prompted the United States to officially accuse China of currency manipulation and could drag the world into a full-scale currency war. Trump questions the seriousness of the negotiations between the two sides and accuses China of stalling until the results of the 2020 US elections are announced, which China denies.

Technically: The bearish and sustained momentum of the GBP / USD pair may push it to test new historical support areas, and the nearest ones are now the psychological support 1.2000, and 1.1925 and 1.1800 respectively, amid continuing Brexit concerns. On the upside, the closest resistance is currently at 1.2120, 1.2200 and 1.2310 and I still prefer to sell the pair from every bullish level. Despite all the technical indicators reaching oversold areas, investors do not prefer to buy the pound sterling yet.

As for the economic data: Today's economic calendar has no important economic data from either the United States or the UK.