For the fourth day in a row, the GBP / USD has been stabilizing on the threshold of 1.2000 psychological support and is struggling not to break through this support to avoid stronger selling and testing new record support levels. The price rebounded slightly to 1.2097 after the announcement of wage growth in Britain to the highest level since the global financial crisis and higher employment, but that was offset by a rise in the US consumer price index. Despite the positive numbers of jobs and wages, the British economy suffers from the darkest expectations about the future of the Brexit, as all expectations currently point to an exit without a deal which supported the contraction of the British economy to its lowest growth in six years in the second quarter of 2019. BOE expected England to reach a full recession if Britain exits the EU without an agreement with the EU. Boris Johnson ignores those expectations, stressing that he is determined to work to get his country out of the Union on the deadline of 31 October and in any situation.

As for the US economy, the US administration abruptly announced the postponement of further tariffs on Chinese products, scheduled for two weeks from now, to give renewed negotiations between the two sides to find a way to resolve the trade dispute that threatens the future of global economic growth. The continuation of this dispute has increased expectations recently that the US economy may be stagnant in the coming months, which may push the US central bank to cut US interest rates, maybe during the meetings of September and October.

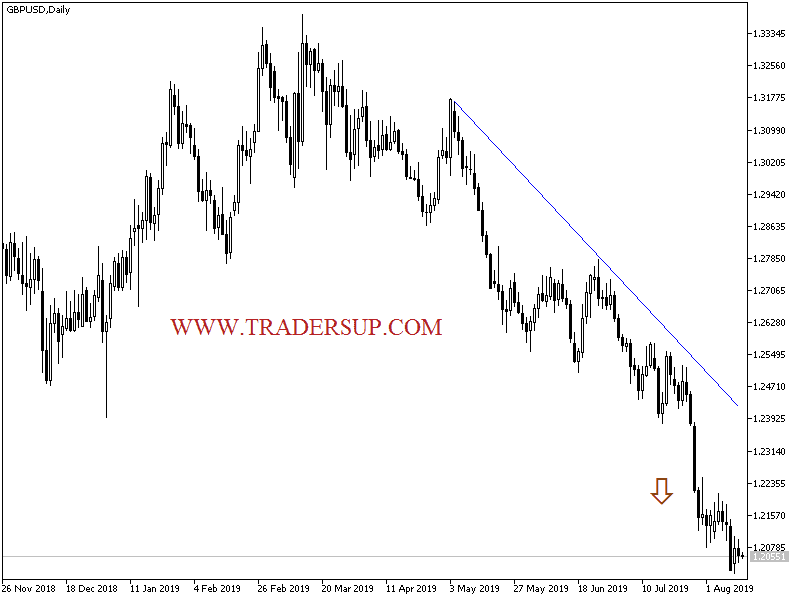

Technical analysis: GBP / USD failed to exploit the recent pressures on the US dollar from the recession expectations of the US economy and the possibility of cutting interest rates, which confirms the strength of the bearish trend of the pair and may culminate in the test of 1.2000 psychological support, with a breach through their may test stronger support levels at 1.1925, 1.1800 and 1.1760 respectively. On the upside, the closest resistance is currently 1.2120, 1.2200 and 1.2310 respectively and overall I still prefer to sell the pair from every rise.

On the economic data front: The British pound is on an important date with the release of British inflation figures, CPI, and producer prices. The US has the Import Price Index and Oil Inventories data announcements.