Investors were counting on the summit between German Chancellor Merkel and British Prime Minister Boris Johnson for a breakthrough on the Brexit issue, which has strained global financial markets and is one factor in the possibility of a global crisis. GBP/USD rebounded to the 1.2180 resistance level, but with the end of this important summit, the pair retreated to the support 1.2111 level as each party sticks to their demands. After going out, Boris Johnson called on the EU to make concessions if they wanted to avoid a no-deal Brexit.

Johnson hopes the EU will eventually accept Britain's terms. French President Macron was quick to respond, and strongly opposed renegotiation with Britain. Macron and Johnson will meet later in the day. Macron's comments confirm the failure of his summit with Johnson before its inception and that uncertainty will continue to dominate the future of Brexit. Financial markets and local governments, led by Germany, are preparing contingency plans to address this. For the first time ever, the German government sold 30-year bonds at a negative interest rate to stimulate the economy.

On the US side, the minutes of the US Federal Reserve's July meeting showed that members will be watching carefully the impact of the data on economic outlook. At this meeting, Fed members voted 8-2 to cut the rate by a quarter of a point. The decision to cut came despite the fact that participants in the meeting generally considered that the negative risks to the future of economic activity has diminished somewhat since their meeting in June.

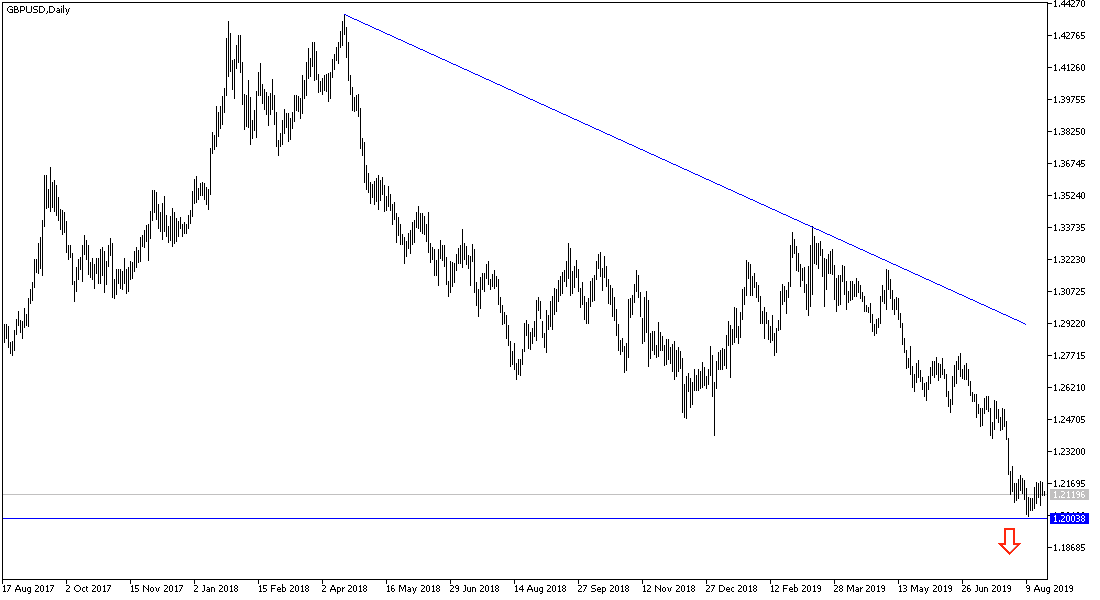

Technically, pessimism about the future of Brexit will continue to be a good reason to continue selling the GBP/USD pair with any upside correction. Resistance levels 1.2185, 1.2245 and 1.2330 may be the closest targets. On the downside, the closest support levels for the pair are 1.2100, 1.2035 and 1.1970 respectively, areas that consolidate the strength of the general trend. We still recommend selling this pair from higher levels.

On the economic data front: The pair is not expecting the release of any significant UK economic data. It is only in the United States that jobless claims will be announced, and any developments from international central bankers who are part of the Jackson Hole symposium organized by the US central bank.