The British pound has gone back and forth during the trading session on Tuesday as we continue to see a lot of choppiness. The market may have gotten a bit ahead of itself to the downside, but nothing has changed that would change the overall attitude of the British pound, and therefore I think it’s obvious that you should be selling and not buying.

The Brexit of course is still up in the air as far as how that’s going to be handled, and therefore it has been weighing upon the British pound against most currencies. The fact that we are trading against the US dollar in this area suggests that we will continue to see the US dollar favored due to the fact that a lot of money runs into the treasury markets for safety. With that in mind, it’s a bit of a “perfect storm”, as the Brexit is still unpredictable, and people are looking to save their trading capital in bonds.

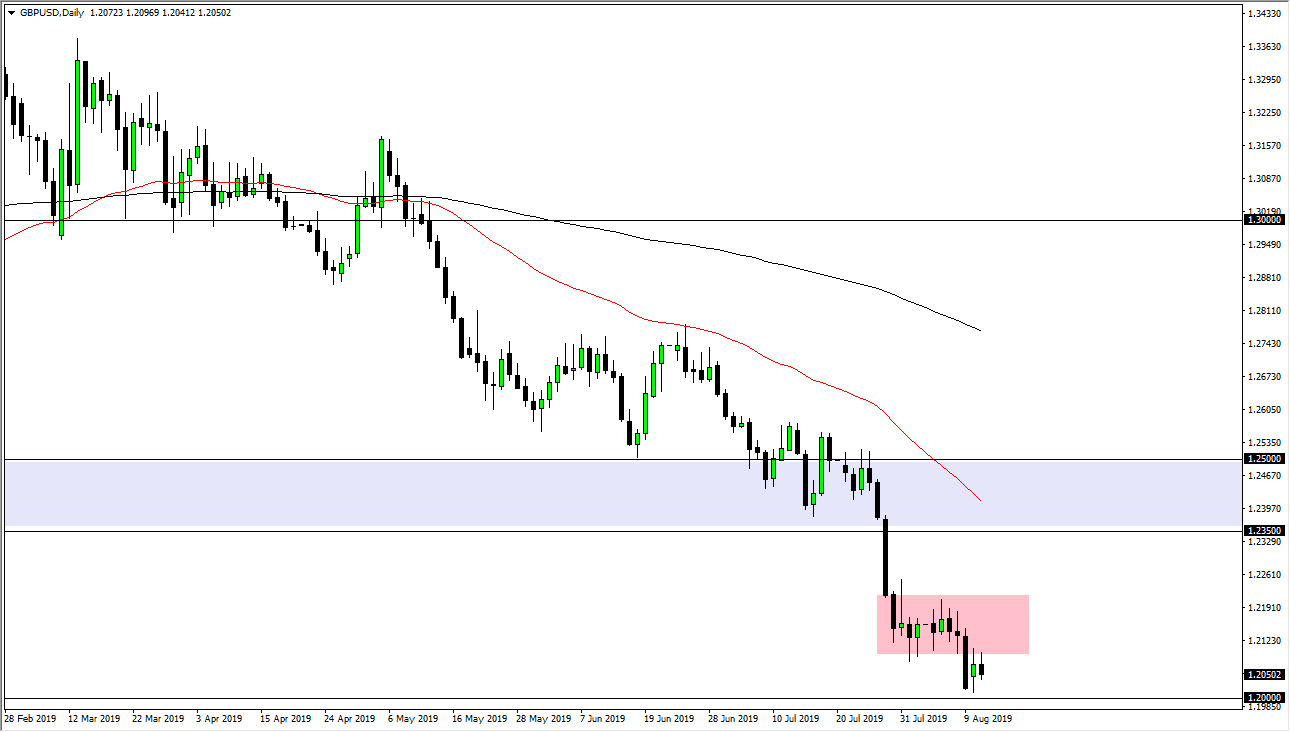

At this point in time it’s obvious that the bottom of the consolidation area from the previous couple of weeks. The 1.21 level should offer resistance as it was once support. I believe at this point the 1.22 handle is also significant resistance, so at this point it’s only a matter of time before the sellers come in and punish the British pound again as there is no end in sight to the drama involving the Brexit. If we can break down below the 1.20 handle, then the market is free to go much lower, perhaps down to the 1.15 handle which is the next major figure. I believe that we have another “big flush lower” coming in this marketplace, as we approach the October 31 deadline for the Brexit to be finalized.

Given enough time, it’s very likely that we will find a career making buying opportunity at that time, but right now we are rather far from seeing that happening, so therefore I think we are looking at a scenario where you fade rallies going forward, and perhaps all the way until it becomes obvious that there will be “no deal” for the Brexit. Let the dust settle after that and then start buying and holding British pounds. Between now and then, we should continue to grind lower, as there is no sign of hope or strength when it comes to this market.