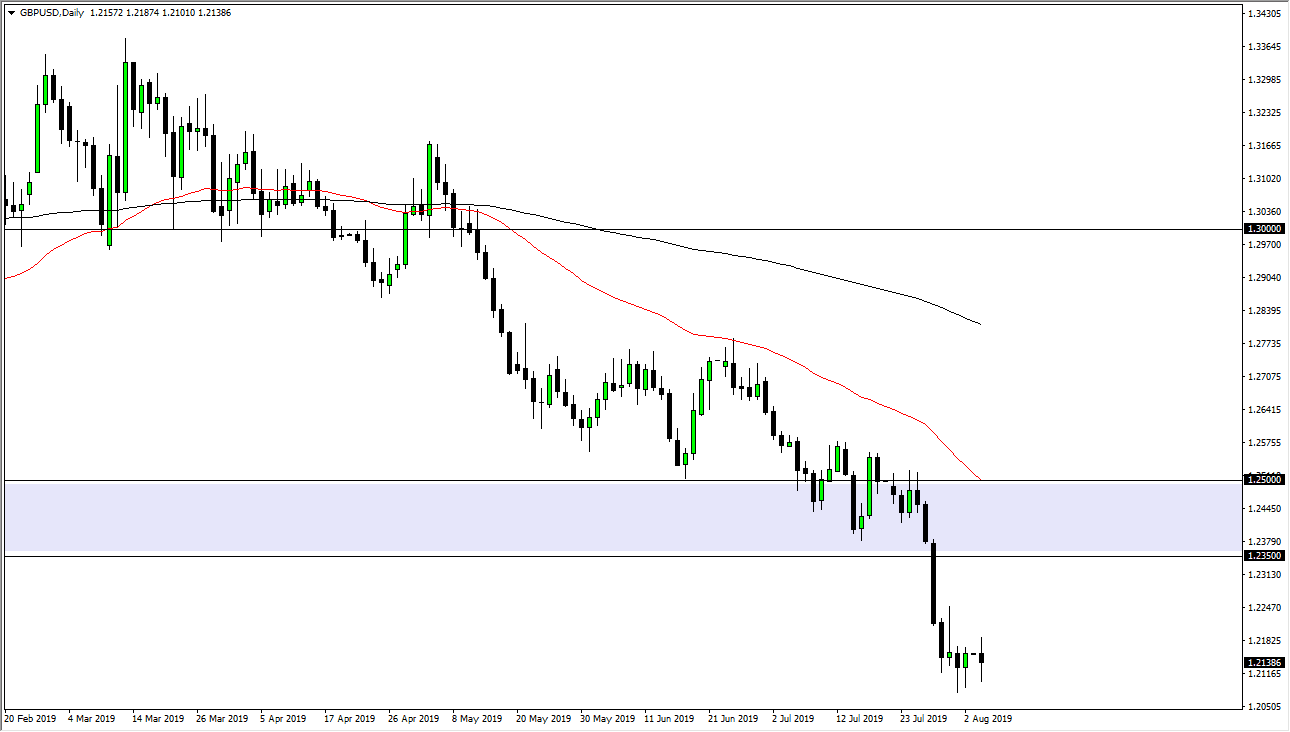

The British pound is negative longer term, but over the last couple of sessions we have seen this market essentially consolidating around the 1.2150 level. Obviously, we favor the downside as this market has been in a downtrend for ages. We still have plenty of issues when it comes to the Brexit, as we don’t really know how things are going to break out above that situation, as we have no idea whether or not there will be a deal at all, or if it will be a “no deal Brexit.”

As long as that’s going to be the case, it’s very difficult to imagine a scenario where you should be looking for value, because no matter what you may think, there is still plenty of issues out there in reasons to think that we will show a lot of volatility. Headlines will continue to be a major problem, as we don’t know what the British are going to do. They can’t even agree amongst themselves so it’s difficult to imagine that there is an agreement between them and the European Union coming anytime soon.

The October 31 deadline looms very large, so between now and then it’s very likely that we will continue the overall downtrend. I think that if we eventually get some type of agreement, that could be reason enough by itself to send this pair higher. Until then, you need to look at the technical analysis and understand that it is horrifically negative, and there’s no reason to think that’s going to change anytime soon. I believe at this point it’s very likely that we continue to see this market find plenty of resistance near the 1.2350 level that extends all the way to the 1.25 handle. Signs of exhaustion in that region should be a nice opportunity to pick up value in the greenback. The alternate scenario of course is that we break down below the couple of hammer candles from last week and reach towards the 1.20 level.

I firmly believe that there is another “flush lower” ahead of that deadline. We will see a massive flush, and then once things stabilize it could be a career making trade down there waiting to happen. That being said, we are a couple of months away from that so I simply look to fade rallies every time they show up.