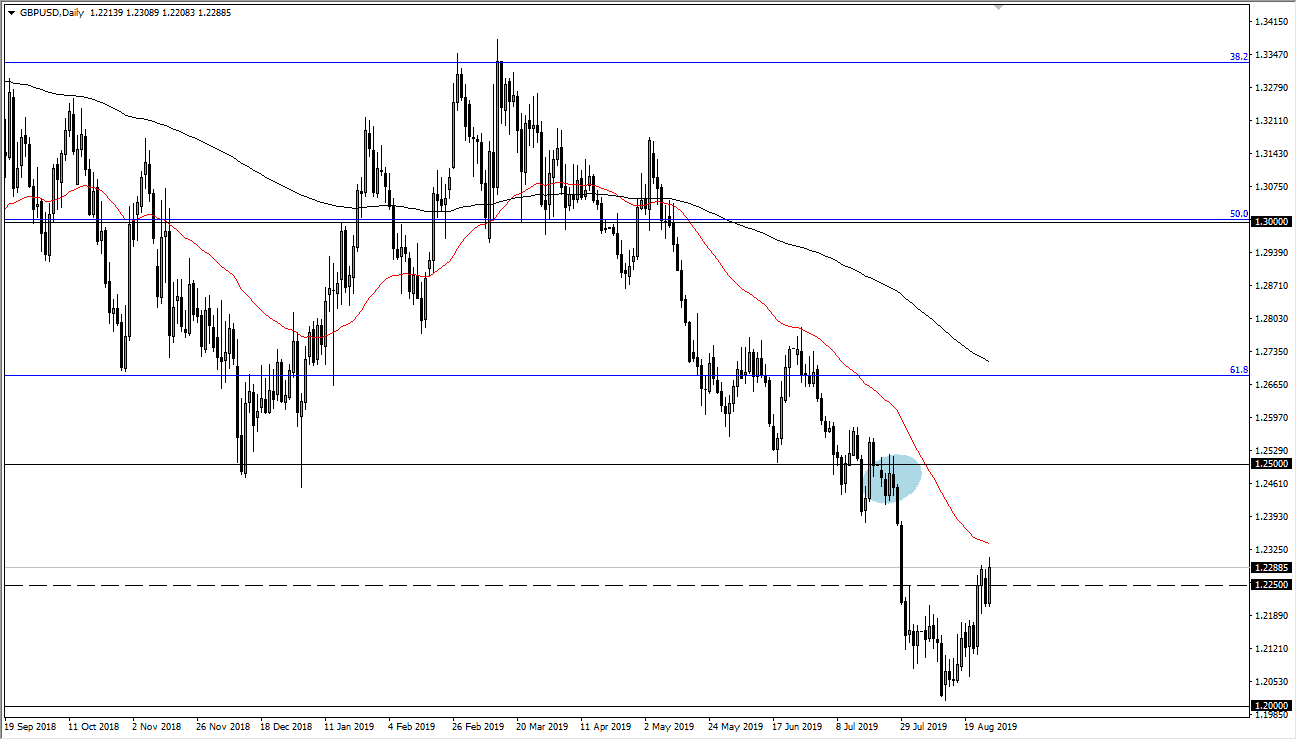

The British pound has broken higher during the trading session on Tuesday, reaching towards the 1.23 level. At this point, the market is starting to pull back slightly on short-term charts but what’s even more telling is that the 50 day EMA is sitting just above. I feel it’s only a matter of time before the sellers come in and start pushing this market back down, because at this point the pair has been trading on the headlines and rumors that aren’t necessarily anything that will stick, just random officials saying random things. There has been a little bit more of a hopeful tone from both the EU and UK leaders, which of course helps the British pound.

Looking at the chart, you can see that the Tuesday session was relatively strong. Having said that, we are still very much in a downtrend and let us not forget that the downtrend is firmly ensconced for reason. The British pound is suffering because there is so much uncertainty around the Brexit. There is still a lot of uncertainty around the Brexit as we approach the deadline October 31 for the British to leave.

Looking at this chart, I believe that the 50 day EMA will cause a bit of selling pressure, and any signs of exhaustion near that level is probably a selling opportunity. However, if we were to break above there and continue higher, then we will probably run into significant resistance at the 1.25 handle. That is a large, round, psychologically significant figure and an area where we have seen more selling pressure again. The fact that we have bounced as far as we have isn’t much of a surprise, because the 1.20 level will attract a lot of attention in and of itself. By bouncing from there it simply shows that the market is paying attention to these big figures.

I do believe that the market will go lower and try to reach that 1.20 level again, but ultimately I also believe that we needed to find a bit of value for the US dollar. I anticipate that at the first signs of trouble, this market dumps again. In fact, I have no interest in buying until there is either a massive flush lower, or some type of change in the attitude of the negotiators that sticks. Quite frankly, nothing’s changed.