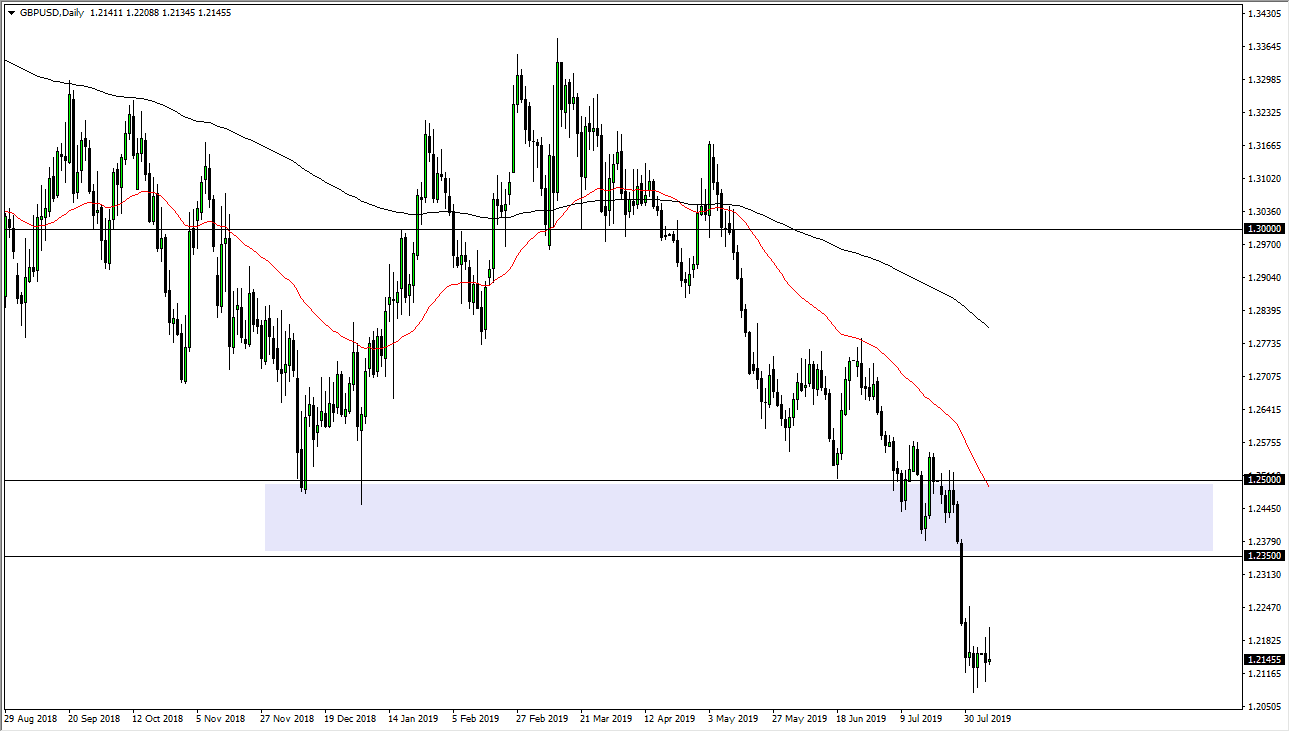

The British pound rallied a bit during the trading session on Tuesday, reaching towards the 1.22 level before pulling back to form a very negative sign. Ultimately, I think that rallies will continue to be sold off and I do recognize that there are plenty of negativity above. Ultimately, the 1.2350 level is the beginning of massive resistance that extends to the 1.25 handle. Beyond that, we also have the 50 day EMA which is painted in red on this chart, breaking through the 1.25 handle.

All things being equal, this is a market that looks very likely to go lower, but we may get the occasional pop higher. I think that the 1.2350 level is a major barrier that’s going to be difficult to get above. At this point, I think that we continue to reach towards the 1.20 level but I don’t like the idea of shorting at this very low level. Any bounce at this should be a selling opportunity, as the 1.20 level underneath is such a juicy target. If we can break down through that level, it’s very likely to continue to go much lower and I do think that happens given enough time. However, we are a bit overdone so I’m looking for some type of value in the US dollar to start getting involved.

I have no interest whatsoever in buying the British pound, unless of course we come to some type of agreement when it comes to the Brexit. If we were to get some type of resolution to the Brexit, then there is the possibility that the British pound takes off to the upside. However, it’s very unlikely to happen in the short term, so having said that it’s likely that we will continue to see plenty of downward pressure. Beyond all of that, the US dollar should strengthen, mainly because the treasury market is attracting a lot of money as there is so much in the way of geopolitical concerns out there. Beyond that, we also have global growth concerns, so both of those will have money flying into the US dollar. Marion that with the idea of Brexit still dragging on, it makes sense that we should continue to see the downtrend going forward. I have no interest in buying the British pound at this point, but I do recognize that given enough time we will probably see a longer-term “buy-and-hold” situation due to a trend change.