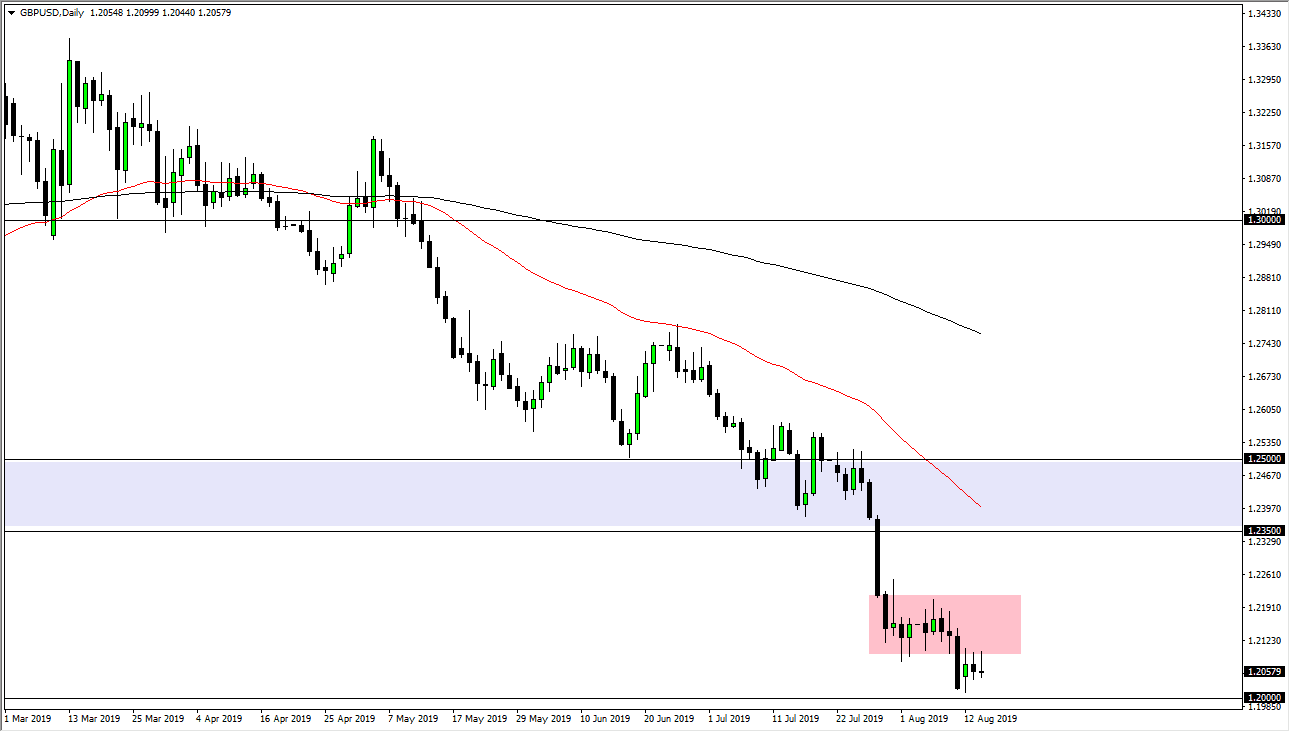

The British pound initially tried to rally during the trading session on Wednesday but then turned around to show signs of exhaustion. The shooting star of course suggests that we can’t go back into the previous consolidation area between the 1.21 handle in the 1.22 level. That’s an area that should cause a lot of trouble, as we have broken down below it and then came back to retest that area.

Looking at this chart, the 1.20 level underneath should be a massive round figure, and at this point I think that we will continue to see sorting opportunities. I think it’s only a matter time before we break down below the 1.20 level, and go looking towards the 1.18 level, followed by the 1.15 handle after that. The British pound continues to suffer at the hands of the Brexit, which of course is completely out-of-control right now and we don’t know exactly how things are going to turn out.

As long as there is this uncertainty out there, it makes sense that the British pound suffers, as markets hate uncertainty. I do think that there is a big major “flush lower” coming in this pair, which might be the last significant move to the downside. Eventually though, I think what we will see it as value hunters come back into the British pound try to take advantage of the market on the cheap. All that being said, I am interested in trying to take advantage of the short-term rallies that show signs of exhaustion as they have been so reliable for months. Yes, we have the occasional snap higher, but those only end up being selling opportunities as well.

With as much money as we are starting to see flow into the bond markets, it makes sense that the US dollar continues to strengthen anyway. Given enough time, I believe that the US dollar will continue to gain against most currencies, as there is a real fear of global recession around the world, and of course the previously mentioned Brexit is a special case in this pair. With that, I think we continue to see a flight to safety and the United Kingdom is probably the furthest thing from that right now. Fade rallies, with a ceiling of 1.2350, I see no way to buy this market unless of course we get some type of surprise agreement between the United Kingdom and the European Union.