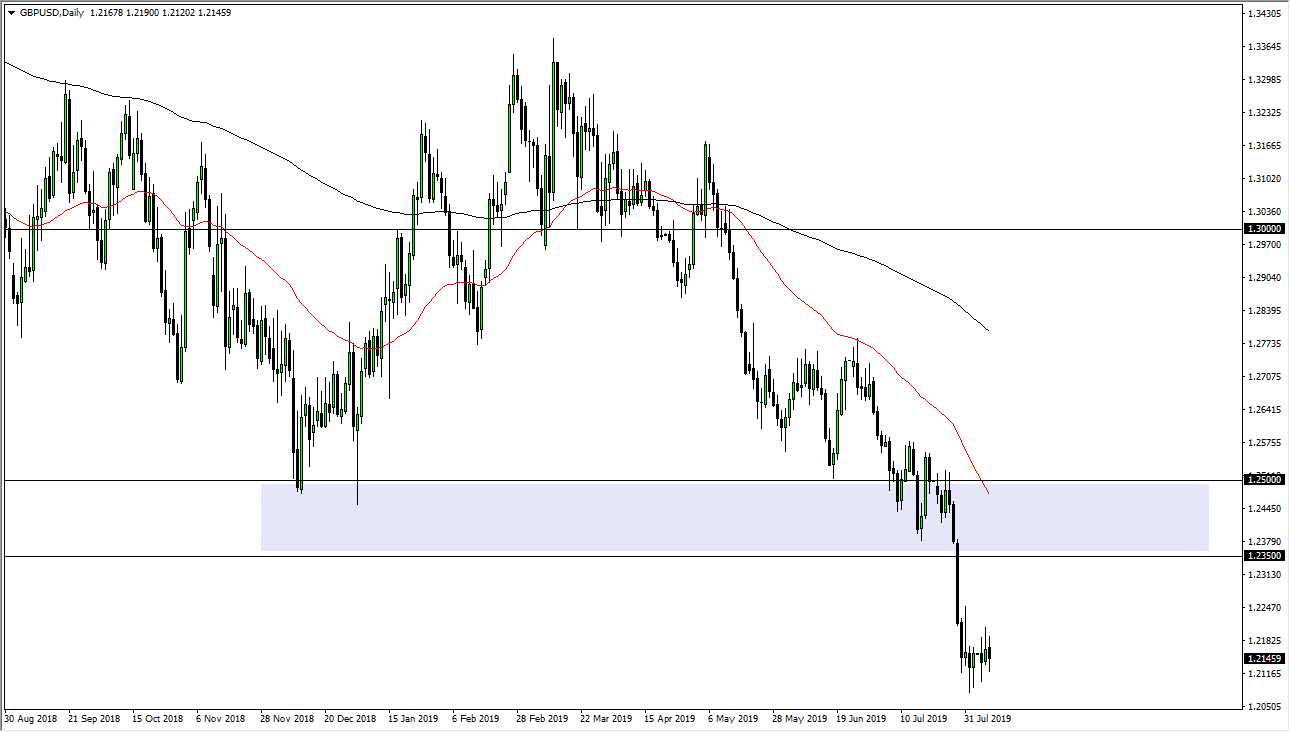

The British pound went back and forth during the trading session on Wednesday yet again as we continue to bounce around the 1.2150 level. This is a market that continues to see selling pressure every time it rallies, but we haven’t broken down over the last couple of days so that means that the very least we are trying to stabilize. Beyond that, we have the 1.20 GBP level underneath that should be significant psychological support. If we were to break down below that level it opens up the “trapdoor” when it comes to this pair.

The most likely scenario is that we get some type of rally based upon whatever reason, and then traders will come back in to punish the British pound. As you can see on the chart I have that same lavender rectangle that’s been up for several days, that starts at the 1.2350 level. To the upside from there, I think that the 1.25 level is the top of this overall consolidation area. That’s an area that should continue to be difficult to break above there, so I think that if we get some type of rally from this area, there will be plenty of sellers in that region. Beyond that, we also have the 50 day EMA that starting to slice through that level, and therefore I think it’s likely that there will be plenty of reasons to sell this market.

Ultimately, I think we need a little bit of a rally to sell off, but I am also aware of the fact that a move below the 1.20 level would be very negative and flood the market with fresh money. Overall, this is a market that continues to fall due to the Brexit and the fact that we just don’t know what to do next when it comes to that scenario. I think at this point we simply fade rallies, as there’s no reason to believe that the Brexit is going to change anytime soon as we don’t even know how it’s going to turn out. It’s been three years, and the British can’t seem to get it together when in reality they can simply just walk away. As long as the British continue to fight themselves, the British pound will be one of the biggest casualties. Eventually we will have a longer-term “buy-and-hold scenario”, but we aren’t there yet.