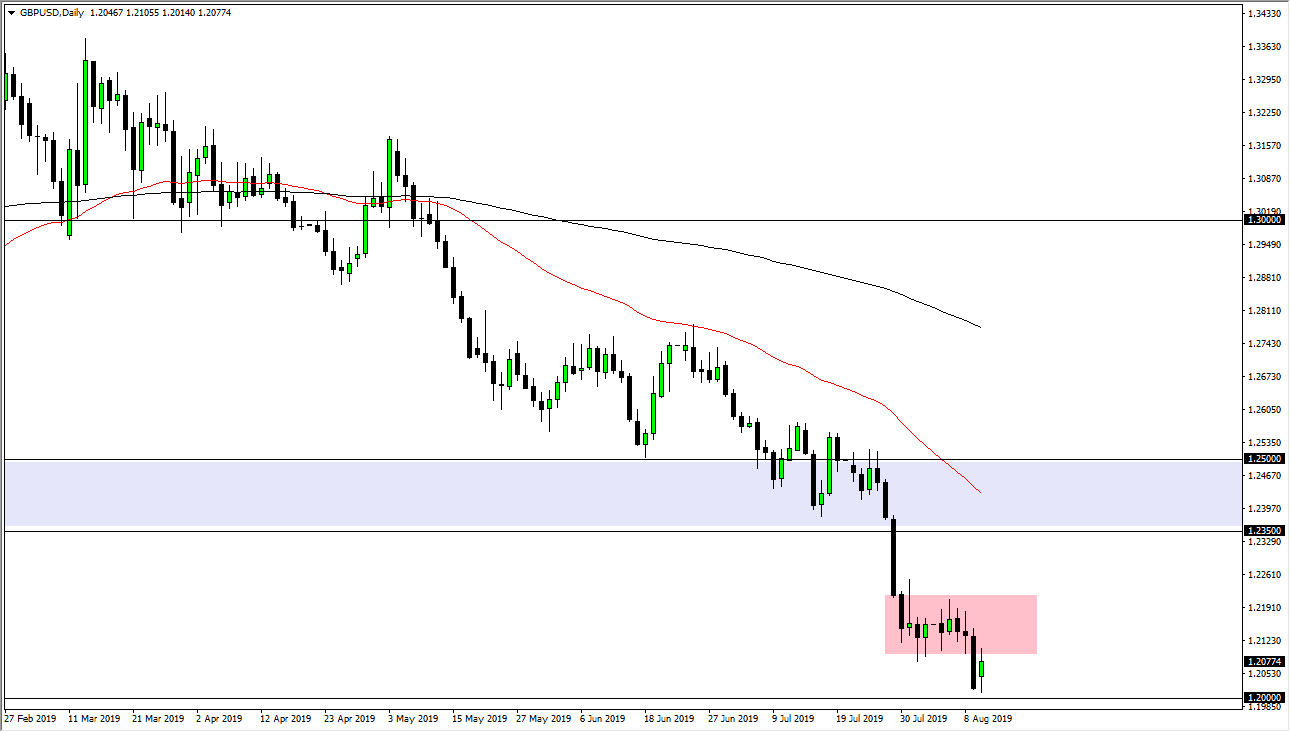

The British pound gapped higher to kick off the trading session on Monday, but then rolled over to test the 1.20 level later on. That’s an area that would attract a lot of attention due to the fact that it is a large, round, psychologically significant figure, and it is of course an area that has been important in the past. The fact that we bounce from there is not a huge surprise, because most currency pairs tend to pay attention to these types of levels.

That being said, we rallied towards the 1.21 handle above, before pulling back a bit from that level. That is an area that was once support for the recent consolidation area, and it is now looking at that level as resistance, due to market memory. The fact that we could not break above the top of that line tells me that the market is ready to go lower, perhaps reaching down towards the 1.20 level yet again.

If we were to break down through that level, it opens up the door to much lower pricing, and that does of course makes sense considering that the Brexit is such a mess right now. The Brexit is up in the air and I have no interest in trying to bet on the British pound right now. I think it’s only a matter of time before we break through there in continue to go much lower. The 1.18 level underneath would be the first target, and then eventually the 1.15 level. I think that level will attract a lot of attention as well, and I do think that another “flush lower” is coming between now and the October 31 deadline. That being said, I believe careers are going to be made by going long the British pound in the darkest hours. We are not there yet, so in the meantime I’m looking to sell short this pair at the first signs of exhaustion on short-term charts. I’m also looking to add aggressively below the 1.20 level.

There is the possibility of breaking out to the upside though, but I recognize the 50 day EMA is the next major barrier which is currently in the previous consolidation area between the 1.2350 level and the 1.25 handle after that. All things being equal, I have no interest in buying this pair but certainly there will be a day where you can ride the trend for years. That’s probably closer to November.