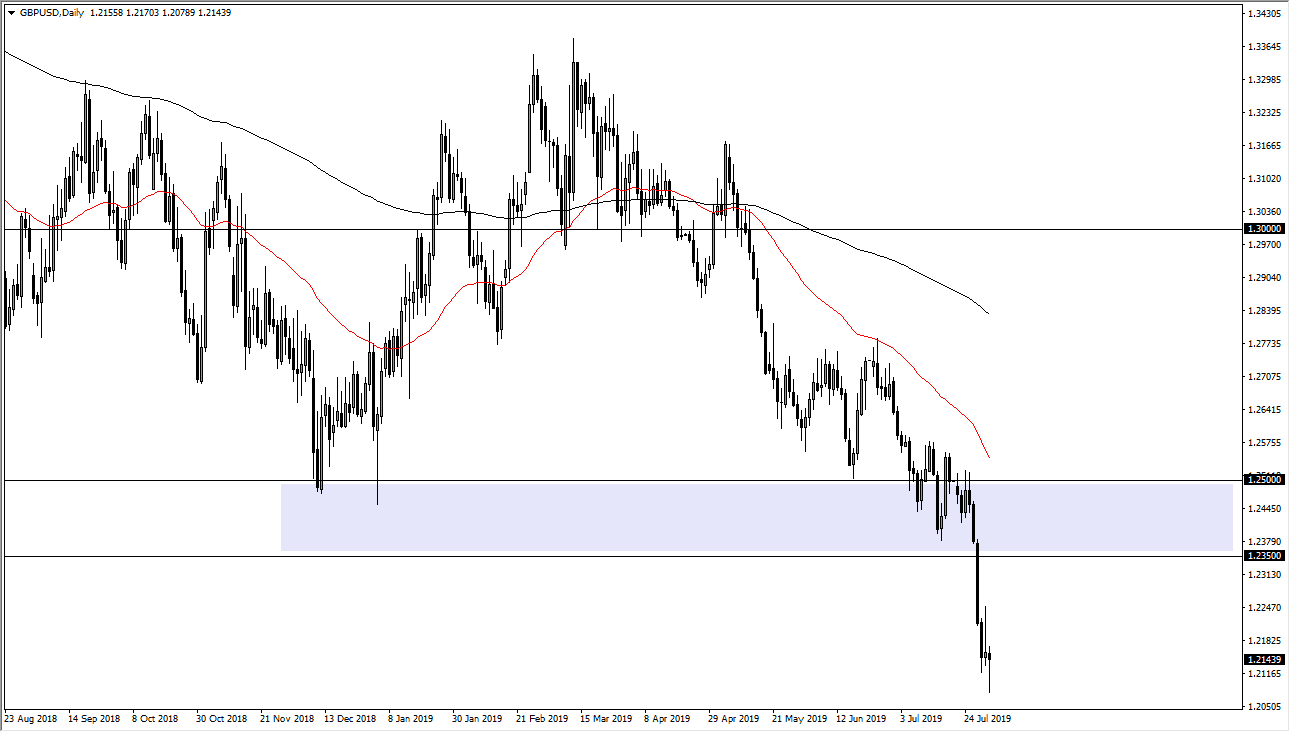

The British pound initially fell during trading on Thursday, but then turned around of form a bit of a hammer late in the day. This goes in direct conflict with the inverted hammer that had formed on Wednesday, showing just how erratic this pair is going to be. Beyond that though, you should look at this in the overall trend, showing signs of just how weak the British pound is, and quite frankly with good reason.

Brexit

The Brexit has obviously been a major deterrent for people buying the British pound. At this point in time, it’s likely that the market will continue to be difficult and negative, so at this point I think it’s a matter of being very patient and waiting for an opportunity to sell at higher levels. The Brexit is still a huge mess, and therefore as long as there is no clarity it’s almost impossible to think that this market will continue to do anything but fall from here. With that in mind, keep in the back of your mind that the deadline for the Brexit is August 31 and Boris Johnson has made it plain that the UK is going to leave.

Technical analysis

The technical analysis on this chart is quite simple: you just look for opportunities to sell on rallies that show signs of exhaustion. At this point, the 1.2350 level above is the beginning of massive resistance that I have marked on the chart all the way to the 1.25 handle. Any sign of failure as we rallied towards that level should be a nice opportunity. Additionally, the 50 day EMA is starting to reach towards the 1.25 level as well, so it’s likely that we will find plenty of selling pressure in that general vicinity.

The alternate scenario is that we break down below the hammer, so that means that the market should continue to go lower, perhaps reaching down to the 1.20 level after that. That’s an area that will attract a lot of attention, so at this point I think it’s only a matter of time before the buyers would jump in there, but that would be short-lived.

Jobs number

The jobs number of course comes out on Friday and that will move the market. Regardless of what the reaction is to the jobs number, I believe that it’s only a matter of time before the sellers come in and push much lower from the area above. However, the inverted hammer and the hammer over the last couple of days could define a shorter-term range that maybe we could even break out of. Obviously, we will give enough time but the next 24 hours could just be massive chopping.

All things being equal you should be following the trend, and if we do get a rally based upon the jobs number coming out of the United States, think of that as a gift. After all, there’s no need to fight such an obvious and strong trend.