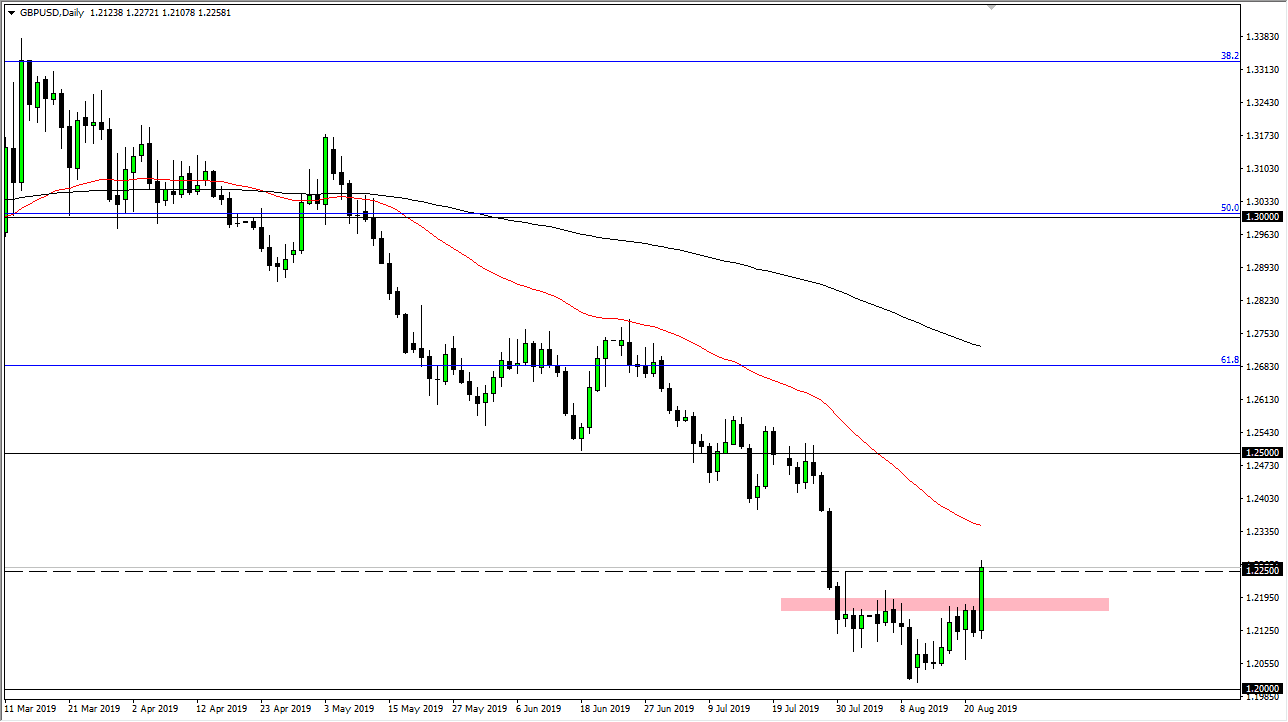

The British pound broke out during the trading session on Thursday, smashing through the pink resistance area that I have marked on the chart. Beyond that, we even reached above the 1.2250 level, an area that I thought could also be resistance. Now that we have cleared that area it’s likely that we will see a bit of buying in the short term, even though it looks as if the trip to Europe by Boris Johnson has been a little lackluster. Ultimately, I think this is simply going to be a nice selling opportunity as the Brexit is still light years away from being solved.

This is a market that has been negative for quite some time and it makes sense that we should continue to see that selling pressure until we get a conclusion to the Brexit problems overall. Above current trading, we have the red 50 day EMA which could come into play as resistance from a technical standpoint. Any exhaustive candle I think it’s good to be an invitation to start selling again as the downtrend has been so strong, and one feels that there is still another “flush lower” still in this market. That’ll be the final capitulation, and then at that point I think the British pound will become the “buy of the century” as we have gotten hammered.

In the meantime, the US dollar continues to attract a lot of attention due to the fact that the Treasury market continues to attract a lot of money. At this point, it makes sense that the US dollar will strengthen because of that, not only because the economic situation and other parts of the world continues to deteriorate, but at the same time the bond market is considered to be safety. In this geopolitical and global economic scenario, it’s not hard to imagine that there will be further runs toward safety, so I’m simply going to stand on the sidelines and look for signs of exhaustion that I can take advantage of and start selling. I have no interest in buying the British pound anytime soon, at least not until we break well above the 1.25 handle, which at that point I’d have to rethink the entire situation. That seems to be very unlikely, at least not without some type of resolution to the entire Brexit uncertainty. We are in a downtrend, and that of course hasn’t changed even though this has been a very impressive day on Thursday.