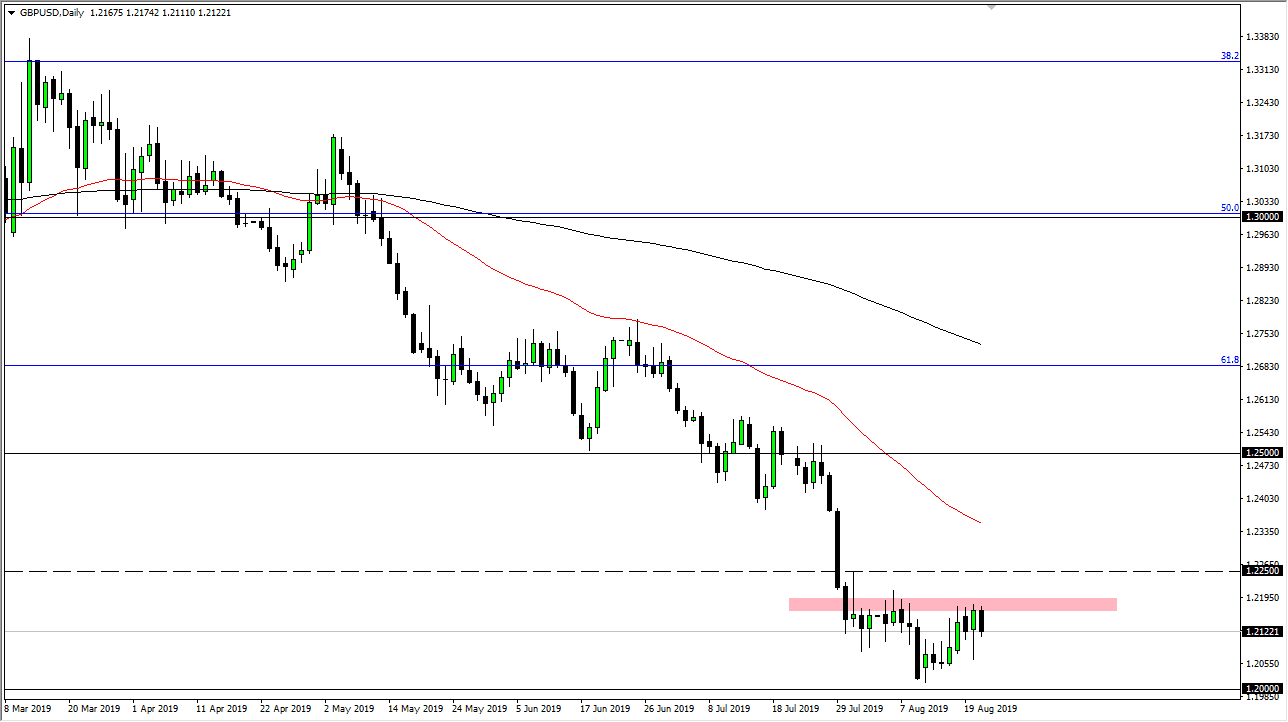

The British pound broke down a bit during the New York trading session on Wednesday as we continued to see a lot of resistance at the 1.22 handle. At this point, it’s likely that we will continue to try to make a move towards the 1.20 level underneath which is a large, round, psychologically significant figure. For the moment, the 1.2250 level is the top of that resistance barrier that we have pulled back from, and it suggests that it’s going to be difficult to break out. If we did break out above there though, then the next think we would be looking at is a move towards the 50 day EMA which is painted in red on the chart.

If we show signs of exhaustion in the near term it’s going to be a nice opportunity to start selling again. If we break down below the 1.20 level, it’s likely that we could continue to go much lower, perhaps down to the 1.15 handle. The Brexit of course is still up in the air and we have no idea what we’re going to do next, so for the moment, it’s really hard to imagine a scenario where the British pound can hang onto gains. With all of that being said, I am short of this market and will remain so, and I do think that eventually we will get the break down necessary to send this market much lower.

As headlines continue to cause problems out there, with the French saying that the “no deal Brexit” is the central theme going forward, and that the British should pay up immediately, it’s likely that we will continue to see a lot of negativity. On the flip side of this scenario is the US dollar which is strengthening due to the US Treasury markets attracting too much money. With this confluence of factors, it’s a bit of a “perfect storm”, and therefore it’s likely that we could continue to go much lower. I have no interest whatsoever in trying to buy this pair, and at this point I think we still have a huge “flush lower” going forward that will show a bit of capitulation that we can start to trade off of. If that happens, then it’s very likely they could be a nice buying opportunity for longer-term traders, but in the meantime it’s all about selling short-term rallies.