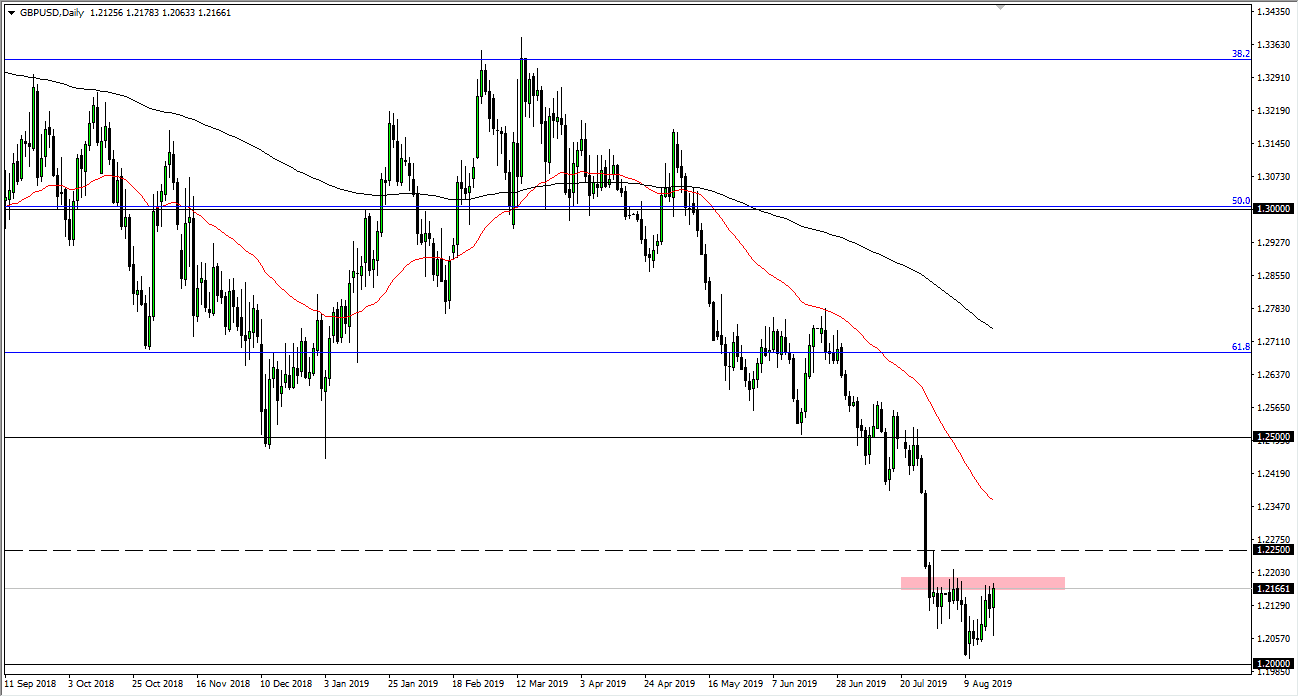

The British pound had a very strong turnaround during the trading session on Tuesday, as we had initially broken down but have turned around to show signs of life again. Looking at the candlestick it’s easy to see that there was a lot of bullishness in the last session, but this is a negative market that not much has changed in recently. At this point, I think it’s only a matter time before the market continues the selling of this pair, with several resistance barriers above that should come into play. For example, I believe that the 1.2250 level will offer resistance due to the fact that we have seen it flipped markets back and forth, and then of course the 50 day EMA which is painted in red on the chart.

The alternate scenario is that we break down again, but the fact that we are closing at the top of the range tells me that there are probably going to continue to be a bit of buying in this area. This means we simply sit on the sidelines and wait to take advantage of exhaustion. The pair may have gotten a bit ahead of itself to the downside, so we may be seeing a little bit of a recovery here.

Underneath though, I think that the 1.20 level will offer significant support, but if we break down below there it’s very likely that the market will continue to go much lower, which after breaking through the 61.8% Fibonacci retracement level it is very likely we go down to the 100% Fibonacci retracement level. With the Brexit still going on and no clarity with that situation being the norm, I think that we will continue to see a lot of negativity. Ultimately, I do think that it’s only a matter of time before we reach towards the 1.15 handle, as we need to have one more “flush lower” in this market as we start to head towards a “no deal Brexit.” I don’t think that we are going to see any type of change in that situation, so I do favor selling the British pound every time at rallies as it offers the US dollar “on the cheap.” Until we get some type of resolution to the Brexit, be it good or bad, I look at this is a one-way trade.