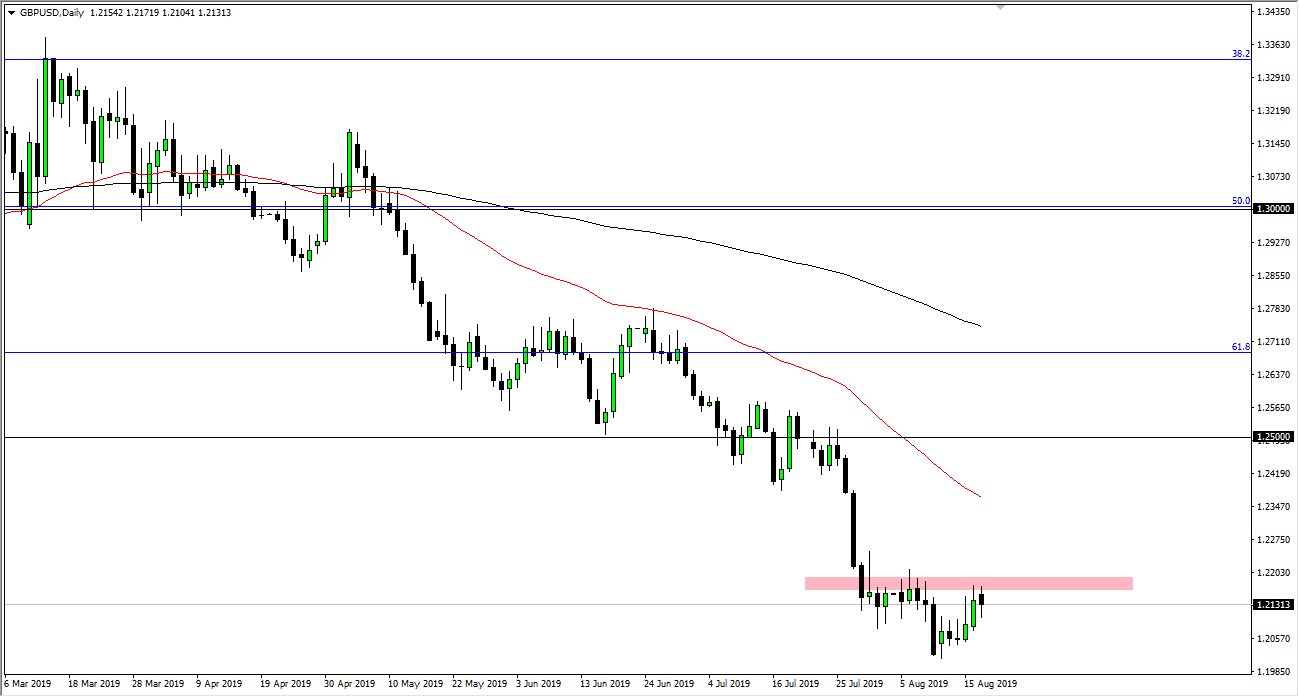

The British pound initially pulled back during Monday’s trading session, reaching down towards the 1.21 handle. However, we have bounced a bit and it looks as if we will continue to look at the 1.22 level above. That’s an area where I would expect to see a lot of resistance, as it has been resistive previously. There are several candlesticks there that suggest there is a lot of order flow near the 1.22 handle, and I think at this point the question is whether or not we will break down here, or are we selling at higher levels?

Notice how I didn’t say anything about buying the British pound. We are a long way away from the idea of some conclusion to the Brexit, and it appears that the British are going to be able to pull it together. I fully anticipate that we should see a “no deal Brexit” down the road, and that should offer plenty of negativity going forward. I think at this point it is only a matter time before the sellers will come back in. I look at any rally at this point as a selling opportunity as there is no reason to believe that anything has changed.

The US dollar of course has been sold off a little bit during the trading session in response to the idea that the Americans and the Chinese may ratchet down tensions in the trade war, but this is going to be short-term to say the least. Ultimately, the market should continue to see plenty of reasons to sell off coming out of the UK by itself. Beyond that, we have also seen a lot of money flowing into the Treasury markets as well, and that of course raises the demand US dollars. Because of this, I think that it’s only a matter of time before the market continues the downtrend overall. The 50-day EMA which is pictured in red above is also resistance, and I think that the market will also recognize that as well. The 1.2350 level will offer resistance that extends to the 1.25 handle above as well. Quite frankly, until we get some type of major “flush lower”, I like the idea of selling rallies but once we get that capitulation, it’s very likely that it will be a longer-term “buy-and-hold” type of situation for a huge move.