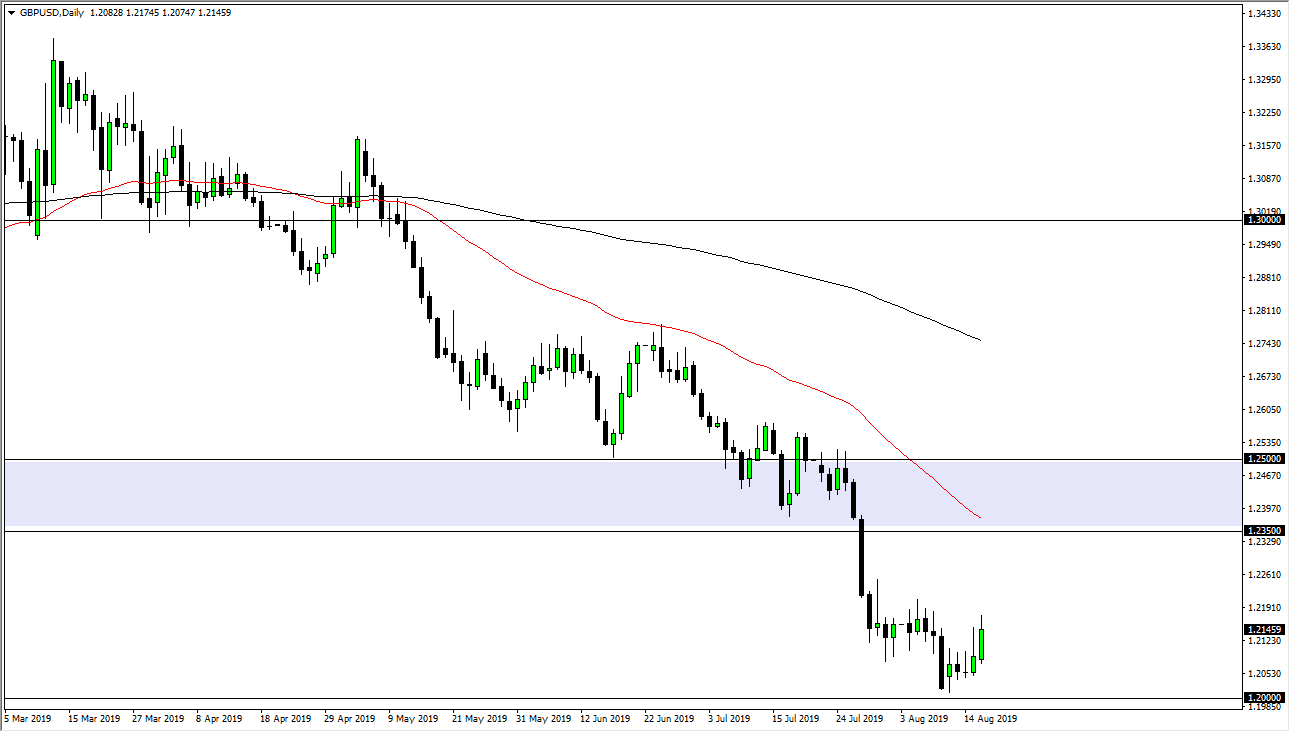

The British pound rallied quite significantly during the trading session on Friday as we reached into the previous consolidation area. This is an area between the 1.21 GBP level and the 1.22 GBP level. I think that we will continue to see sellers in this general vicinity, so it does not surprise me at all to see that the market gave up some of the gains at the end of the day. Ultimately, I’m looking to trade short-term rallies in this market as the British pound continues to cause nice selling opportunities. Keep in mind that the Brexit is still a huge mess, and with some meetings, over the weekend we could get a bit of volatility.

Because of those meetings and of course just the weekend in general, I believe that we are likely to see a bit of volatility, but at this point, it’s obvious that we are very much in a downtrend and I don’t think that’s going to change. Even if there were good headlines coming out of the weekend, at that point I would anticipate that the 50-day EMA which is pictured in red should be a major issue. All things being equal, it’s very likely that the US dollar will continue to attract attention anyway because we have so much in the way of demand for the Treasury market. Ultimately, this is a market that is not only negative due to the Brexit, but the fact that there is a major wave of concern when it comes to the global growth story out there which of course looks very negative.

With all that I don’t see any reason to be a buyer, even if we do get a nice gap higher. To be honest, the only thing that would have me looking to buy the British pound would be if all of a sudden there was an agreement between the UK and the EU that sorted itself out. We are a long way from that happening, so I think that any rally at this point is going to be a nice opportunity to short. Even though there was an impressive candlestick on Friday, I wouldn’t put so much weight on that because it’s before the weekend.

To the downside, I see the 1.20 level offering significant support but I think it’s only a matter of time before we break down below there. Once we do it opens up the idea of a move down to the 1.18 level, possibly the 1.15 level after that. We are getting close to the October 31 deadline for the UK to leave the European Union though, so at this point in time, things are about to get very interesting.