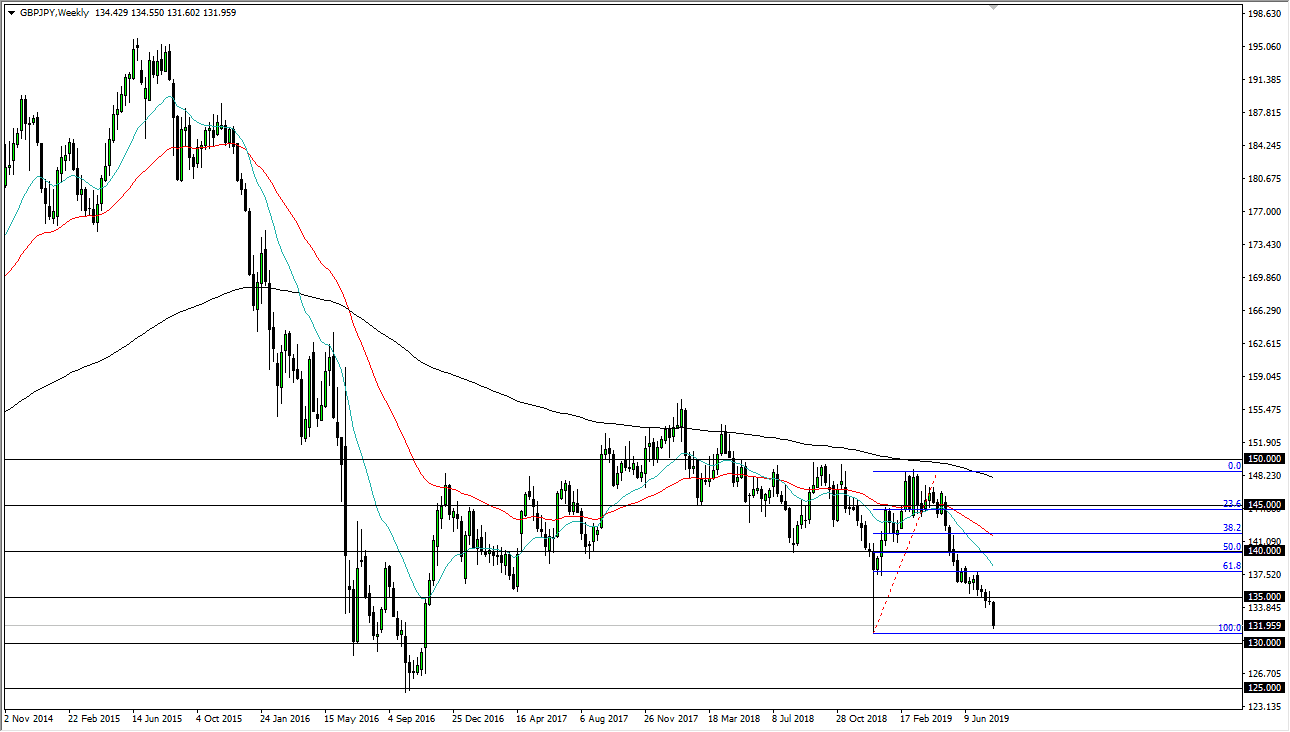

The British pound has broken down rather significantly late in the month of August, as we continue to see a lot of negativity around Sterling in general. As I write this, we are getting close to the 100% Fibonacci retracement level of the bounce that we had seen just above the ¥130 level, and now it looks likely that we are going to test that hammer that sent the market back to the upside, and if we break down below there, which is likely, then we could go lower.

At this point, the ¥130 level would be somewhat supportive, and it’s likely that a break down below that level could send this market much lower, perhaps down to the ¥135 level. That does make sense considering that we have a lot of issues when it comes to the Brexit, and that of course will continue to weigh upon Sterling in general. I don’t like the British pound, at least not yet.

While I think the British pound could get a little bit of a bounce against the greenback due to the Federal Reserve early in the month, it’s difficult to imagine a scenario where he jumps against the Japanese yen because most traders will be looking to take on a lot of risk at this point, and even if they did it wouldn’t be in the form of British pounds.

Longer-term, we will get that “flush” that I’ve been talking about for some time against the British pound, and when we do I think that the market will find a bit of stability that we can take advantage of. Once that stability appears after major selloff, as of course would be sent into the markets due to a “no deal Brexit”, then I think longer-term “buy-and-hold” traders will continue to jump into this market and think of it more or less as an investment. We are several months away from that happening, so at this point I think rallies are to be sold, but I do believe we break down below the ¥130 level soon.