As expected, the US Federal Reserve cut US interest rates by a quarter point, despite that the US dollar recorded strong gains against other major currencies, as the vote on the cut was not unanimous among the bank's monetary policy members. The bank indicated in its monetary policy statement that they trust the performance of the US economy, and according to the governor of the bank, Jerome Powell, the cut in interest rates will not be the course of the bank's policy and will not be continues. Federal Reserve Chairman Jerome Powell described the rate cut as "essentially a mid-session adjustment to monetary policy." Powell suggested that a rate cut should not be seen as "the beginning of a cycle of sustained interest rate cuts. That is not what we see now, that is not our view now” he added.

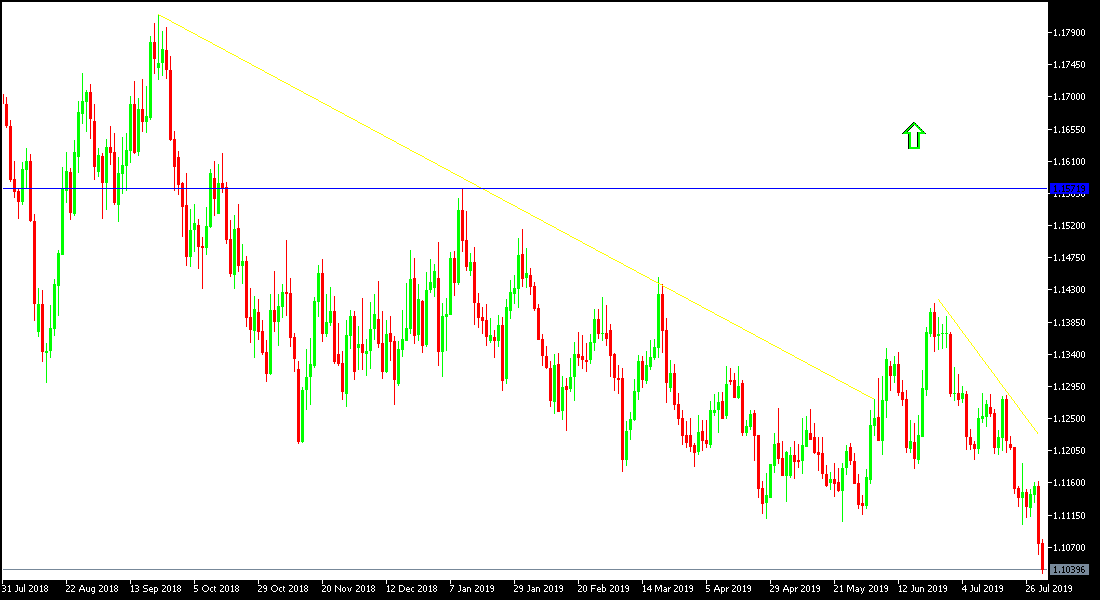

The bank's confidence in the performance of the US economy and the lack of adoption of the interest rate cuts, mainly supported stronger gains for the US dollar, which contributed to stronger gains of the EUR / USD to the 1.1033 support level at the time of writing. The latest move supports the decline.

As we expected, we now confirm that the divergence of economic performance and monetary policies between the Eurozone and the US, will continue to favor the US dollar. The European Central Bank (ECB) kept the interest rate unchanged at 0.00% but hinted at the monetary policy statement, and confirmed by Mario Draghi, that the bank is determined to provide more stimulus plans for the Eurozone economy, which is suffering from a slowdown due to the global trade war.

Technically: the EUR / USD pair is strengthening bearishly and testing the 1.1000 psychological support will open the way to complete the test of stronger support levels. The next support levels might be 1.0980 and 1.0900, respectively. At the same time, technical indicators reaching areas of strong selling saturation may stimulate the investors to turn to buy the pair from now. On the upside side in the event of a bullish correction, the resistance levels will be 1.1120, 1.1200 and 1.1310 as the nearest targets for correction. We still prefer to sell the pair from every ascending level.

On the economic data front, the economic calendar today will focus on the announcement of the industrial PMI from the Eurozone economies. From the US, there will be announcements for Unemployment Claims and ISM Manufacturing PMI.