Ahead of the release of a batch of important US economic data, the EUR / USD is stabilizing below the 1.1200 psychological support level, with stronger losses reaching the 1.1130 level, before settling around 1.1150 at the time of writing. Recent economic indicators confirm the depth of the German-led Eurozone slowdown. The growth of the German economy shrank as expected and confidence in the performance of the German economy weakened to the lowest level in eight years. The global trade war continues to negatively and continuously affect the region's economy, which depends on industry and exports. This general weakness will force the European Central Bank to accelerate the introduction of more stimulus plans, including cutting interest rates to the negative zone, which are now at zero. The Euro suffered a further setback amid the Italian political row, paving the way for early elections and a return to concern about the budget of the region's third largest economy.

As for the US economy, it is still the best performer so far in comparison with the Eurozone. Despite the mixed results of the recent US economic data, it is in the best overall. The US inflation rate has risen but is still far from the Fed's target. Surprisingly, the country decided to postpone the imposition of more tariffs on Chinese imports, which were slated for Sept. 1, and it seems that the United States of America does not want to enter into a currency war with China. Expectations by international financial institutions that the US economy may enter recession soon, as trade dispute with China widens. Therefore, the US Federal Reserve may move to cut interest rates to counter that.

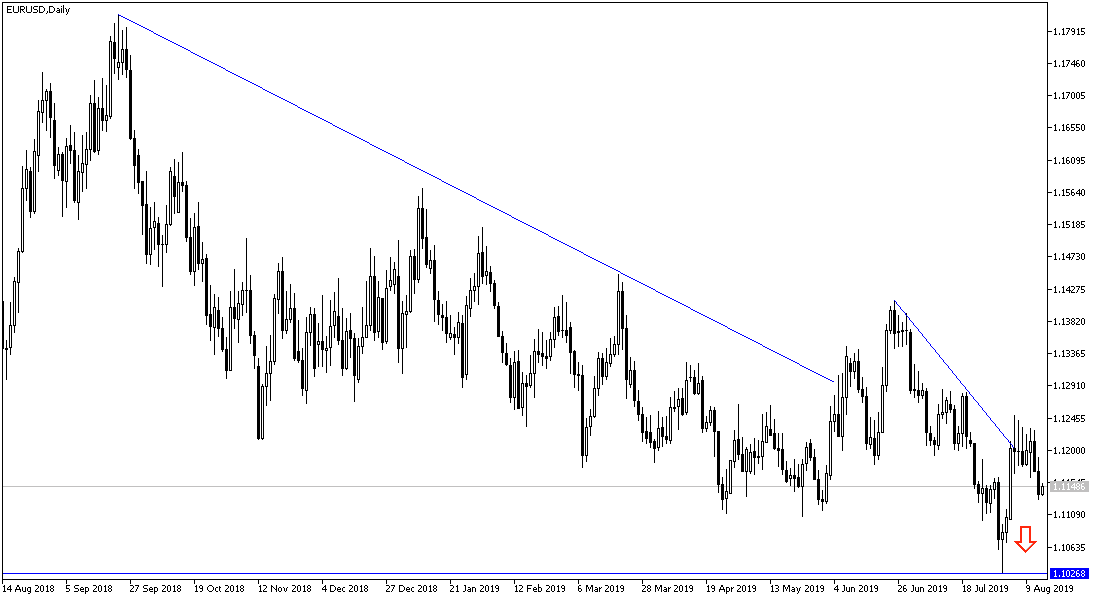

Technically: The general EUR / USD trend continues to strengthen downwards. As we expected before, we now confirm that stability below 1.1200 psychological support will support this trend and test support areas at 1.1140 and 1.1080 and the 1.1000 psychological support respectively, as the overall economic weakness in the region, as well as monetary policy expectations, negatively affects the single European currency. In case of a bullish correction, the resistance levels 1.1225, 1.1300 and 1.1420 will be initial targets. I still prefer to sell the pair at every bullish level as the EUR / USD keeps moving within a strong bearish channel over the medium and long term, and investors are ignoring technical indicators reaching oversold areas.

On the economic data front: All focus today will be on the release of the US economic data, namely retail sales figures, the Philadelphia Industrial Index, non-farm productivity, jobless claims and industrial production.